Posted January 15, 2024

By Zach Scheidt

Turning Empty Cubicles Into Houses

The real estate market is constantly adapting as our society evolves. Take the rise of Airbnb as one recent example.

Vacation rentals flooded the marketplace as Airbnb grew in popularity and hosts listed spare rooms, or even entire homes, on the platform.

Properties that had previously been occupied by families became full-time vacation rentals, tightening the residential real estate market.

And hotels had to reinvent themselves to stay afloat in this more competitive environment. All this to say real estate changes with the times.

Right now we're on the cusp of the next big transition, one that will reshape cities across the country. Allow me to explain…

Office spaces are the building blocks of every major city’s downtown. Of course, the pandemic forever changed the nature of white-collar work and offices.

These spaces have been in limbo for years while it remained unclear when office workers would return — or whether they would return at all.

Now four years since the start of the pandemic, it appears hybrid work models are here to stay and business districts may never return to full capacity.

Meanwhile, housing is still limited in many of these same cities and residents often struggle to afford living in them.

This dynamic has created a clear mismatch; cities have too many offices and not enough housing. But a solution is emerging.

Major cities have been working to convert excess office space into housing. While this is a straightforward solution, it won’t be easy to pull off.

As always, there will be winners and losers of this next major shift in real estate trends.

So let’s examine how cities are solving their housing shortages by converting office buildings into residential spaces.

Cities Need a Better Work-Life Balance

The pandemic may have helped turn bustling business districts into ghost towns overnight. But it’s not entirely responsible for today’s office vacancy problem.

America’s office surplus actually started when a Reagan-era change in the tax code allowed investors to depreciate commercial real estate more quickly.

This helped real estate investors lower their tax bills and get easier loans, paving the way for an office development boom throughout the 1980s.

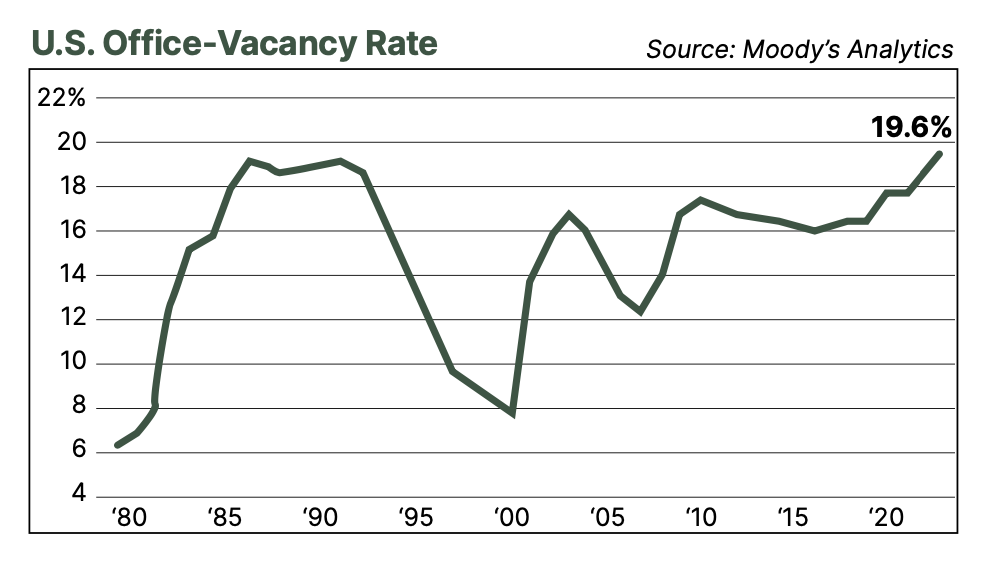

As you might expect, the new crop of office buildings in America’s cities flooded the real estate market and office vacancy rates skyrocketed.

Eventually, the spaces began filling with white-collar workers. But economic hardship, notably the dot-com crash and Great Recession, spiked vacancy rates again in the 2000s.

As shown in the chart above, the vacancy rate in the United States hit a record high of 19.6% last year. Or put another way, that’s roughly 1 billion square feet of empty space!

To be clear, this is unleased office space. Whether these offices have workers coming in and how often is another issue entirely.

Remote work during the pandemic obviously heightened the vacancy problem. But the truth is America’s major cities have had too much office space for decades.

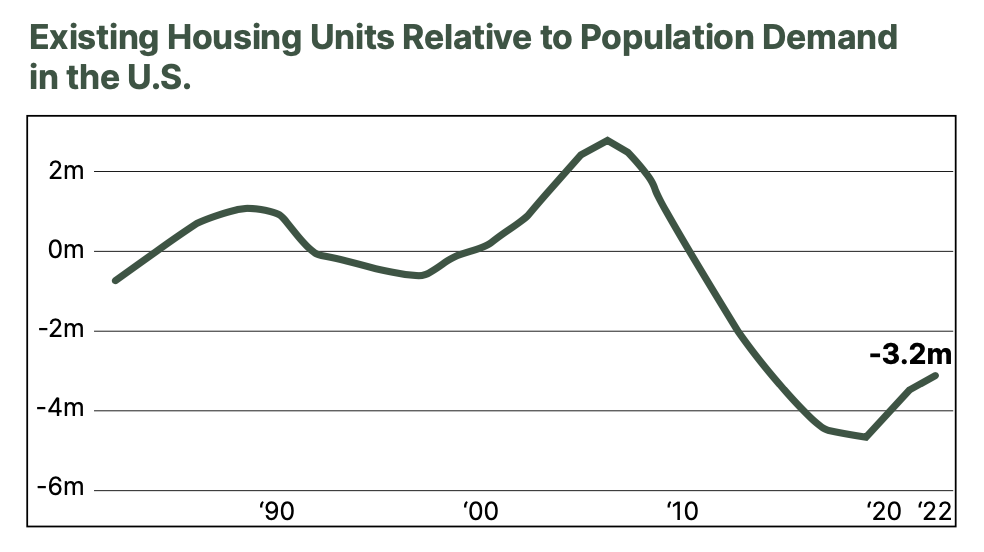

Meanwhile, these same cities have a severe housing shortage. Currently, there’s an estimated deficit of 3.2 million housing units in the U.S.

And simply building more homes won’t help dig the country out of this deficit any time soon, either.

Together these two charts tell a clear story. America’s cities have too much empty office space and not enough housing.

This same issue is happening in major cities all over the world, even if at a different scale.

The steep imbalance means real estate investors are bleeding money on their commercial spaces while residential properties are still in high demand.

Keep in mind that many of these office buildings also have debt that needs refinancing over the next few years.

But with higher interest rates, the revenue from these buildings can't cover the financing costs in their current state.

Now you might think the solution is obvious. Just redevelop the vacant properties and build more housing, right?

Well, it’s turning out to be a bit more complicated than that…

Retrofitting Old Offices Is Hard Work

Much has been said about taking vacant office space and converting it into residential units. And many big cities have started to help with this transition.

Last year, San Francisco city planning officials moved to adjust building codes and eliminate fees on such projects.

The White House has even offered resources to help convert high-vacancy commercial buildings to residential use.

However, this is a difficult job to pull off, even with the extra assistance.

For one thing, local zoning laws could still prevent developers from converting a building from commercial to residential use in the first place.

After clearing this first hurdle, the fact remains that office buildings are laid out completely differently from apartment buildings.

Newer high rises in particular are often so big that an apartment floorplan simply won’t work in the same where an office once was.

Think about concerns like installing plumbing for individual apartments or making sure every unit has access to a window that opens.

Depending on the building in question, structural issues like these could make it difficult or impossible to turn an office building into housing.

Ironically, old office buildings generally make better candidates for conversions than new ones, according to those in the business.

Since they were constructed before central air conditioning, older office spaces are smaller and have better access to windows for ventilation.

So it’s easier to work out an apartment floorplan without running into the issue of windowless units in the center of the building.

Office-to-apartment conversions were already on the rise before the pandemic. Remember, the office surplus has been a problem for decades.

But now I believe we’ve finally reached a tipping point. And I expect this to be the defining real estate trend over the next several years.

Currently, there are an estimated 2,600 office buildings in the U.S. that are viable candidates for residential conversion.

Converting offices into housing will prove both difficult and expensive. But there is an investment angle to it all.

You see, there are a handful of industrial companies that specialize in making technology to update older buildings.

This includes things like installing new high-efficiency HVAC systems for comfort and energy savings…

Electrical, lighting, and security upgrades for safety and lifestyle along with digital building management.

And don’t forget about other essentials like updating building fire protection systems.

Companies that produce these in-demand technologies to retrofit old buildings stand to win big as cities convert office spaces into housing.

Many of these companies are already seeing their order backlogs rise as the trend takes off.

So they make great investments for this next major shift in real estate.

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King

All Sizzle, No Steak: On the Hunt for Profitable Tech

Posted January 05, 2024

By Zach Scheidt

2024 Election: Here’s What Happens

Posted January 03, 2024

By Jim Rickards