![5 Stocks I'd HATE for You to Own [CHARTS]](http://images.ctfassets.net/vha3zb1lo47k/77A6UiOlVSpb5EILBW9THE/0595f4f91922740c72f84388de967484/shutterstock_1461429284.jpg)

Posted February 10, 2023

By Zach Scheidt

5 Stocks I'd HATE for You to Own [CHARTS]

Greetings from Heber Valley outside Park City, Utah! I’m here on a guys' retreat this week with some of my networking friends from Atlanta.

One of my friends recently sold his business and now has a part-time house in the beautiful mountains of Utah.

The weather has been great, and we've enjoyed lots of time in the snow.

Yesterday I had a long conversation with Kyle about one of his favorite stocks. It's a very popular (and expensive) technology name.

As with many speculative stocks, shares have been ramping higher in early 2023. But I'm a little worried looking at the company's fundamentals.

There's a big chance my friend could lose a lot of money when reality hits and these speculative stocks start trending lower once again.

Today I want to show you some of the most dangerous stocks I see in the market right now.

If you've got a position in one of these companies, you may want to consider letting it go before the stock moves lower and hands you a loss.

The Worst Stocks Rise to the Top

Since the beginning of January, many of the worst stocks in the market have trended higher. This is fairly common during a bear market rally.

Many of the worst stocks traded sharply lower at the end of 2022 thanks to tax loss selling and some investor panic.

It's natural for some investors to buy the dip and for other traders to start covering their short positions to lock in profits.

But now that we're several weeks into this bear market rally, things are starting to get crazy.

Stocks of many worthless companies — or companies that won't generate profits for years — are up 80% or more.

You and I have seen this story before, and we know that it doesn't end well.

Eventually, stocks have to trade at a price based on the company's assets and expected profits. Without tangible assets or legitimate profits, these stocks will soon roll lower.

Lately, interest rates have been rising, which could turn out to be the catalyst for these speculative stocks once again entering a bear market.

So consider today's alert a warning of sorts.

If you're a more aggressive trader, you may even want to consider buying put contracts on some of these names.

Put contracts rise in price when stocks trade lower. So buying puts can be an excellent way to capitalize on stocks expected to trade lower.

Here are five stocks I expect to roll lower over the next few weeks…

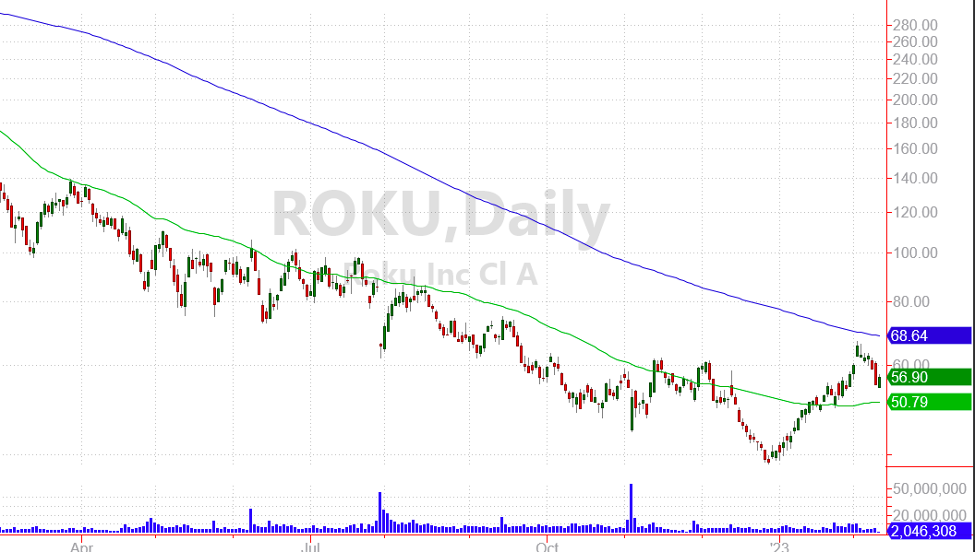

1: Roku Inc. (ROKU)

Roku operates a video streaming platform with more than 59 billion hours of content streamed in 2020.

The company's platform is very popular with customers. But ROKU is a money-losing enterprise that’s expected to continue losing money for years to come.

If you add up the value of all ROKU's shares, investors still value the company at $8.7 billion. Would you pay $8.7 billion to buy a company that's losing money? I didn't think so!

The stock has been falling for months, but the stock benefited from a relief rally in January.

I would use this rally as an opportunity to sell. It's just not a quality stock that you want to own in a challenging environment like we have today.

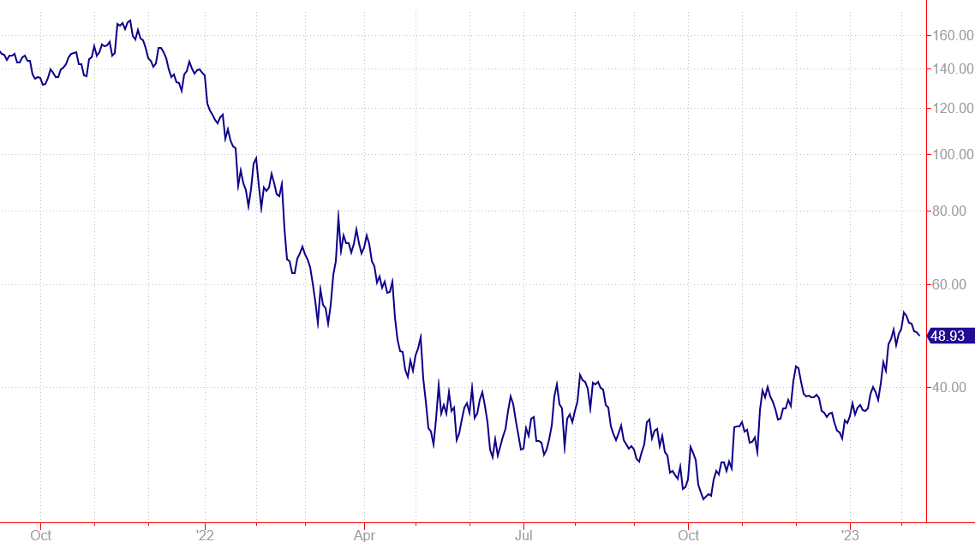

2: Shopify Inc. (SHOP)

Shopify offers an e-commerce platform that helps small and midsize businesses capture payments.

While this is a valuable service, the stock is simply way too expensive compared to the profits that SHOP generates.

This year the company will earn just 8 cents per share.

Those profits are expected to grow to $0.26 per share in 2024. But do you think Wall Street analysts really know what will happen in 2024?

Even assuming this projection is correct, shares of SHOP are trading for roughly 200 times expected profits for two years from now.

That means you're paying $200 for every dollar the company might earn in a couple of years. That's absurd!

As you can see in the chart below, SHOP has moved sharply higher this year. But that just means there's a much bigger risk for investors if SHOP turns back lower.

Please don't be caught holding this stock when the bear market rally turns lower.

3: Twilio Inc. (TWLO)

Twilio has a cloud-based software platform that allows developers to create applications that use voice and video functionality.

And while that sounds very exciting, there are dozens of cloud technology companies like TWLO competing for customers and investor attention.

It's a tough area to be invested in right now. But that hasn't kept investors from buying stocks when managers use buzzwords like artificial intelligence, open architecture, or integrated applications.

Similar to SHOP, this company is expected to earn just $0.13 per share this year. And as time goes on, expectations have been revised lower.

That's a big red flag for me when I research a company.

If you buy shares of TWLO today, you're paying roughly 87 times expected profits for two years from now.

It's not a bet I want to take and I worry that TWLO will hand investors some big losses again this year.

4: Unity Software Inc. (U)

Unity has created software that allows studios to create 3D content for gaming, virtual reality, and other applications.

With all the artificial intelligence applications and talk about virtual and augmented reality, you’d think Unity would be making a lot of money.

But the company will earn just $0.22 per share this year. As more information comes in, investors have been revising expectations lower.

So I don't have a lot of confidence the $0.22 will be realized this year.

Sure, Unity may grow over time. But investors are paying roughly 61 times expected profits for 2024.

And again, it's difficult to know what the company will earn two years from now. So I would be veryhesitant to own shares of this stock.

Proceed with caution, or sell your shares now and wait for a better time.

5: Wayfair Inc. (W)

Wayfair sells more than 33 million home goods products to consumers in the U.S. and Europe. It basically works as a middleman between retailers and a large customer base.

While this sounds like a great business, the company is not profitable and isn't expected to generate a profit anytime in the foreseeable future.

What good is a company with 33 million items if it can't turn a profit?

All together, shares of Wayfair are valued at $7.2 billion. That's an absurd valuation for this business and one that carries a lot of risk.

As the bear market rally runs out of time, I expect Wayfair to trade lower. Don't get caught holding shares when this happens!

It's been a crazy market so far in 2023. Quality stocks have been biding their time while trash stocks have been rebounding.

Don't get distracted and put your retirement at risk.

Focusing on the best companies that generate reliable profits and pay dividends will serve you very well in the long run.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King