Posted March 17, 2023

By Zach Scheidt

A Gift From the Banking Crisis

"Never let a good crisis go to waste." - Winston Churchill

The last few weeks have been extremely turbulent for investors, especially those holding shares of America's mid-tier banks.

Thanks to rising interest rates, falling customer deposits, and a healthy dose of fear, many of these stocks have been trading sharply lower.

Tomorrow I'll give you some more details about what’s happening behind the scenes. But in the meantime, I want to focus on one important opportunity this turbulent market has created.

Just like Churchill looked for ways to use a crisis to his advantage, you can turn the banking crisis into more income in your investment account.

And that income can help grow your retirement wealth despite the challenges in today's market. Let's jump in!

The Banking Crisis Creates Opportunity

If you’re a long-time reader of Rich Retirement Letter, you probably know I have a soft spot for dividend stocks.

Many of the largest and most profitable companies on Wall Street pay investors a portion of their quarterly profits in dividends.

If you own shares of these stocks, you get paid like clockwork every three months. And your dividends often grow over time as the company's profits steadily increase.

Today's banking crisis won't keep companies from distributing dividends. And in most cases, it won't keep these dividends from growing over time.

So we could argue that the banking crisis shouldn't affect the price of these dividend stocks. After all, we still expect reliable income for years and years to come.

But the banking crisis has caused many dividend stocks to pull back. And therein lies the opportunity...

Take a look at the chart below that shows the price action for the ProShares S&P 500 Dividend Aristocrats (NOBL), a fund that invests in America's highest-quality dividend stocks.

As you can see, the fund traded lower over the last couple of weeks as fear entered the stock market. But think about what's really happening here...

Investors are worried about banks having cash on hand to pay depositors. But they're not worried about whether dividend companies are going to keep paying investors.

So why should the country's largest, most stable dividend companies pull back? This is actually turning out to be a great buying opportunity!

The Same Income at a Cheaper Price

When I invest in dividend stocks, I generally think about the investments this way: I'm paying cash now to buy a long-term stream of income.

If I expect this income to be stable and grow over time, then I should be excited any time I can invest at a cheaper price.

So when NOBL or the stocks that are included in this fund pull back, you're able to get more income for every dollar you invest.

That's quite different from the perspective most investors have.

Traditional investors worry when quality stocks trade lower. But income investors salivate at the opportunity to buy their favorite dividend plays at a lower price.

Tapping Into the Best Income Opportunities

If you want to take the easy route to collect more income, you can simply buy shares of NOBL.

This is a great way to generate a healthy income, especially now that the fund has pulled back.

To be included in this fund, a stock must have a long-term history of both paying and increasing dividends to investors each year for decades.

So NOBL is full of reliable income stocks that have withstood the test of time. But if you want to go one step further, I’d love for you to pick out your favorite stocks from the fund.

That way you can tap into some of the specific companies that are doing well in today's dynamic economy.

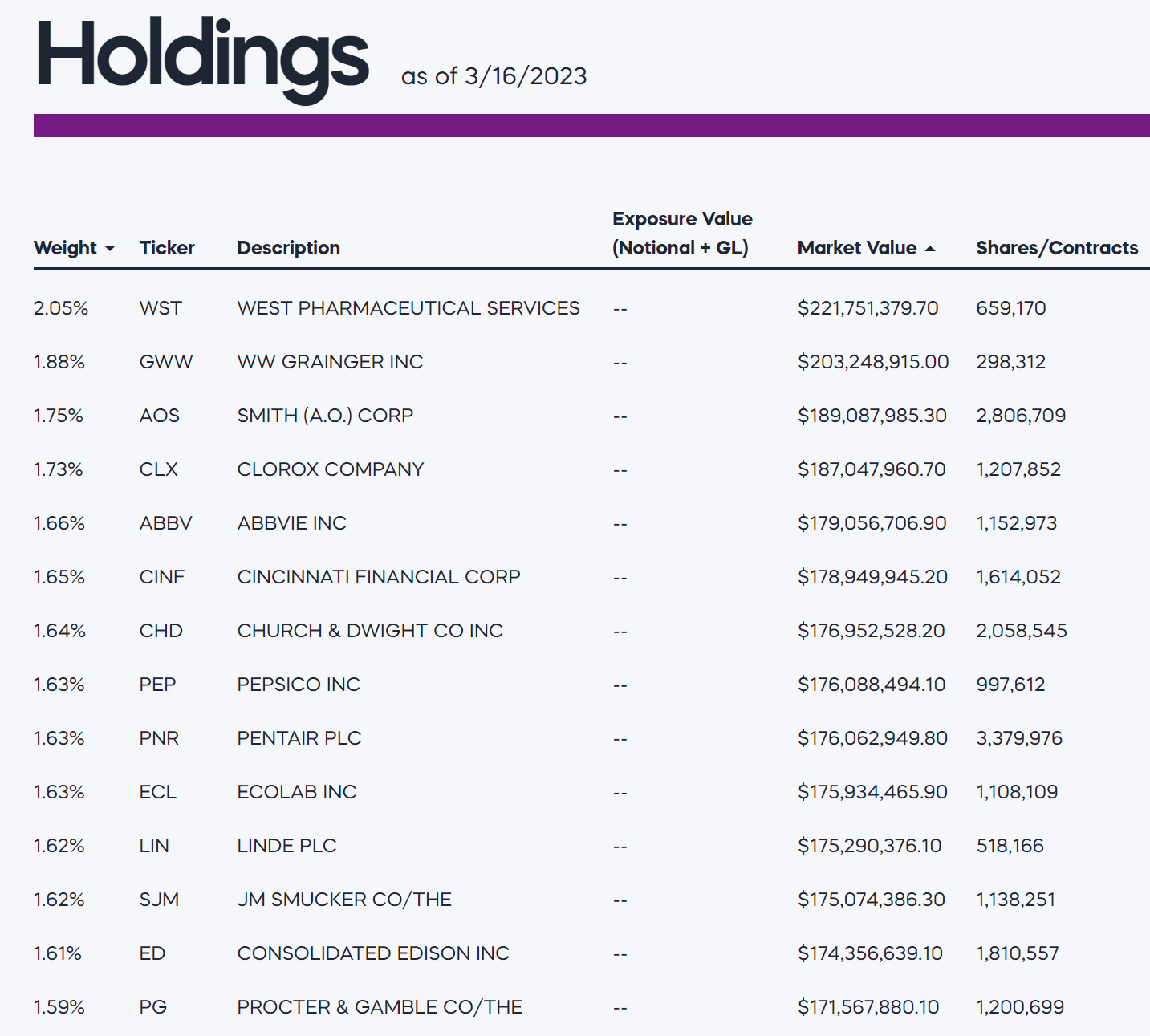

Here's a quick screenshot I grabbed of the top stocks NOBL invests in.

If you're a do-it-yourself investor, I recommend spending some time with this list over the weekend.

Do your homework, pick out your favorite three or four stocks, and start putting your retirement capital to work next week.

After all, the banking crisis has given us some great deals on income plays. And according to Churchill, you never want to let a good crisis go to waste!

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King