Posted January 30, 2023

By Zach Scheidt

Are we REALLY doing this again?

This month has been like a rerun of a terrible movie…

Specifically the one where speculative tech stocks take off only to come crashing back to Earth once cooler heads prevail.

Frankly, I'm more than a little concerned, because a lot of investors got hurt the last time the stock market acted like this.

I don't want that to happen to you. So, I'd like to share an important warning to help protect the wealth you've worked so hard to save.

January's Complete Reversal of Fortune

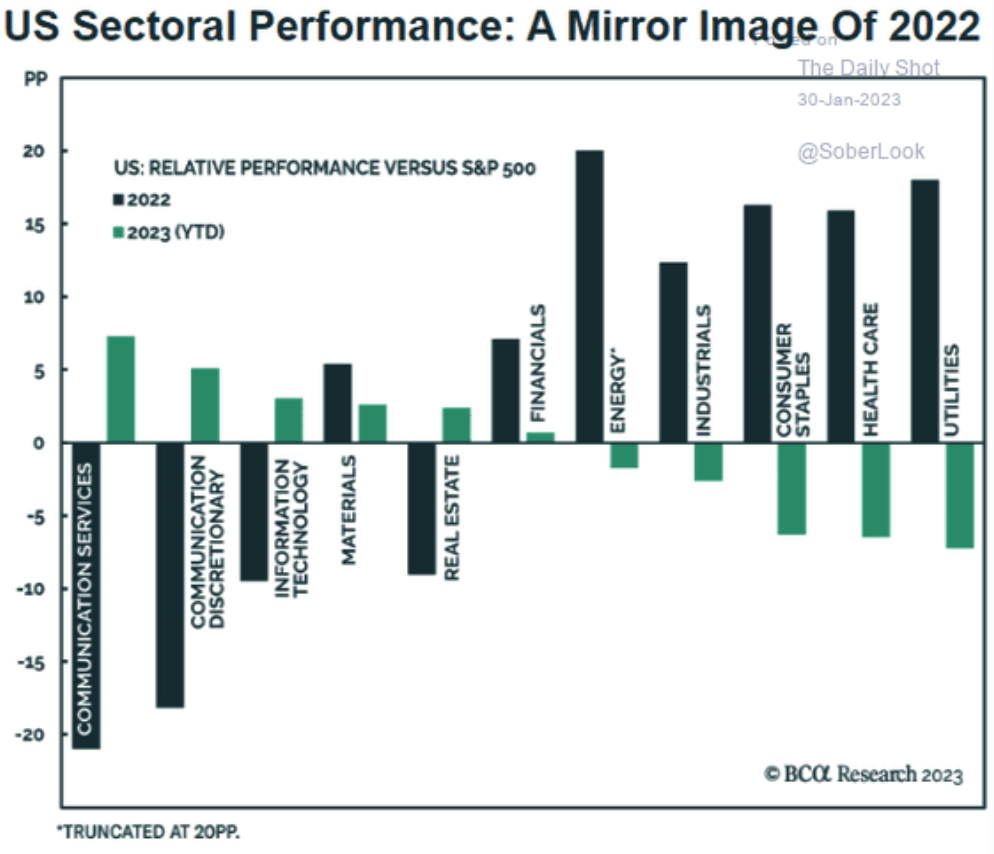

I came across an interesting graphic this morning that I also shared on my Twitter feed.

The dark green bars show each area of the market’s performance in 2021, and the bright green bars show their performance so far this year.

It's as if the entire investing community made a New Year's resolution to stop buying quality companies that generate profits and pay dividends.

Instead, investors are flocking back to the speculative growth stocks that caused them so much pain for the past year and a half.

Just take a look at some of the riskiest stocks in the market right now…

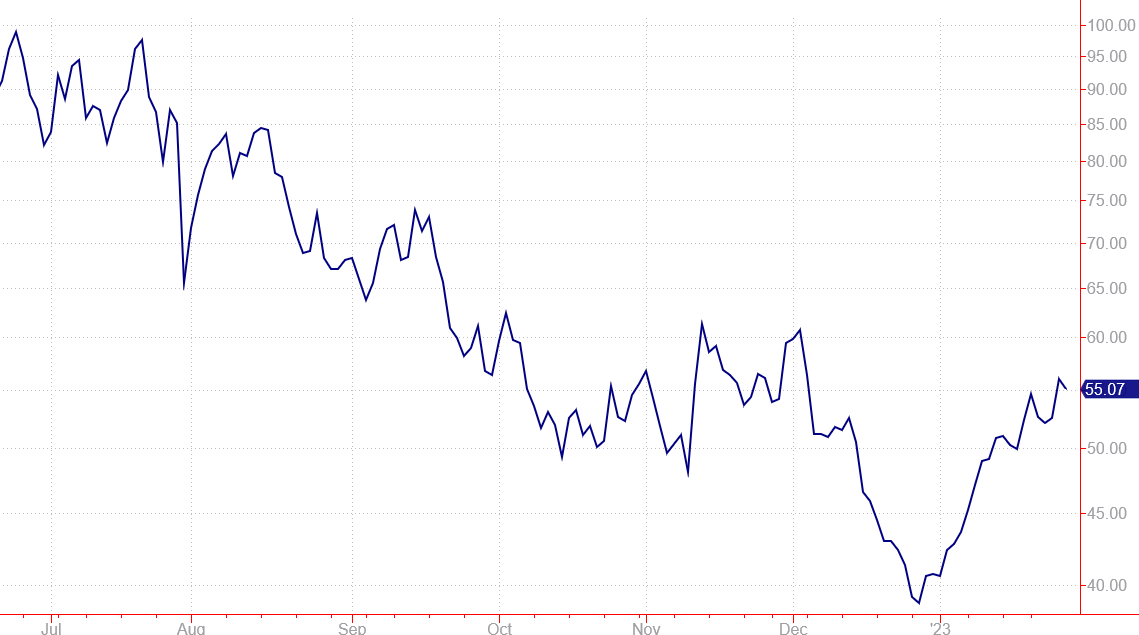

Carvana Co. (CVNA) is almost certain to declare bankruptcy in the coming months, but the stock is up around 180% from its December low.

Or consider the streaming platform Roku Inc. (ROKU). Although the company isn't profitable (and isn't expected to be anytime soon), investors have pushed the stock up over 43% so far this year.

Even shares of Tesla Inc. (TSLA) have shrugged off the devastating decline from last year and surged 80% higher in a matter of weeks.

So what gives? Are these companies really more valuable now than they were at the beginning of the year?

Is it time to throw caution to the wind and buy? Are speculative growth stocks out of the woods?

Nothing Changed Except the Stock Prices

The more I research the growth stocks trending higher in January, the more convinced I am that this is a false rally.

Fundamentally, not much has changed about the speculative stocks on my bearish watchlist.

Their share prices are still exceptionally high compared to earnings (or lack thereof), which leaves the stocks even more vulnerable to rolling back lower again.

The truth is this kind of rebound is fairly normal in a bear market.

When the dot-com bubble burst and even during the 2008 financial crisis, there were periods when speculative stocks ramped higher for a few weeks.

The action sucked in vulnerable investors who wanted to believe the best. But in the end, speculative stocks fell to more reasonable prices and investors who bought the rally were hurt.

Don't let that happen to you! Instead, use this short-term reversal to your advantage.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King