Posted June 08, 2021

By Zach Scheidt

BUY ALERT: 3 "Inflation Busters" to Protect Your Retirement

"The rise in inflation is only temporary," they tell you…

"The Fed has been trying to get inflation higher for years," the financial media say…

It seems like every time I turn around, I hear another skeptic talk about why the recent rise in inflation doesn't matter.

But we both know better, Reader{{FirstName}}Reader.

You've got to pay your bills.

When you fill your car up with gas, it takes more out of your wallet.

Buying groceries, clothes and paying your utilities has become more expensive.

And don't get me started on the cost of homes, rental rates or even fun things like prices for hotels and flights!

All you have to do is look at the data and you'll see that inflation is picking up.

Whether that inflation is temporary or here to stay, it still takes more of your retirement savings to live your life.

So today, I want to help you fight back against inflation!

By investing in the three stocks I'm going to share today, you should be able to grow your wealth faster than the rate of inflation.

This should leave you with more cash to spend on the things you need — and want.

To Beat Inflation, Leverage the Power of Higher Prices

When fighting the effects of inflation you need to grow your wealth faster than the rate of inflation.

After all, if you just match the rate of inflation and continue to spend money on your day-to-day expenses, the true value of your savings will deteriorate.

Instead, you want to make sure that your savings are growing fast enough to both cover the money you're spending and keep your wealth growing fast enough to keep up with inflation.

That means the investments you make have to grow steadily. And they have to grow quickly so that today's higher inflation doesn't eat away at your wealth.

Today, we're going to talk about some investments that leverage the power of inflation to give you even more growth.

When you hear the term "leverage," you may instinctively think of riskier investments.

That's natural. After all, many risky investors use the power of options or other investment tools to leverage (or accelerate) their returns.

I'm not talking about this kind of speculative trading for your retirement account…

Instead, I'm talking about investing in companies that have more benefits from inflation.

That way, as inflation kicks in, the returns you receive will be much greater due to the benefits these companies enjoy.

As corporate profits and the value of assets these companies own move higher, your investment will grow.

And as you'll see below, the growth should help you handily beat inflation — growing your true wealth over time.

Inflation Buster #1: Invitation Homes Inc. (INVH)

Long-time readers of Rich Retirement Letter know that I'm a big fan of Invitation Homes Inc. (INVH). This company was formed by The Blackstone Group (BX) after the financial crisis.

INVH currently owns about 80,000 homes in some of the hottest residential real estate areas such as Atlanta, Orlando, Dallas, Seattle and Southern California.

Many of these homes were purchased at extreme discounts during the financial crisis.

By renting out these homes to tenants, INVH can generate reliable income.

That income is then used both to pay dividends to investors and to reinvest into new homes to keep the company growing.

Recently, the sharp rise in home prices has helped drive shares of INVH higher. And I have a lot of confidence this trend will continue as inflation pushes home prices even higher!

By concentrating its homes in key areas of the country, INVH can scale its operations and keep its costs low.

The company can employ teams of maintenance and remodel professionals to keep its homes up to date and attractive.

And by taking good care of its homes and serving its tenants, INVH has been able to keep its occupancy rate very high.

In fact, last month the company boasted a 98.3% occupancy rate!

This high occupancy rate ensures that the company's rental income will remain steady, funding reliable dividends for us as investors.

If you buy shares of INVH today, you'll start with a dividend yield of about 1.8%. But over time as rental rates rise, I expect your dividends to increase.

Meanwhile, the higher price of homes makes INVH as a company more valuable. After all, when you own shares of INVH, you own a piece of the 80,000 managed by the company.

Consider buying some shares of INVH today and maybe hold some extra cash to purchase more shares any time we get a pullback.

Inflation Buster #2: Eagle Materials Inc. (EXP)

High demand for new homes along with the anticipation of a new infrastructure bill are helping to drive prices for construction materials higher.

That's great news for Eagle Materials Inc. (EXP), a company that produces many of the resources necessary for these important projects.

Eagle Materials sells cement and other concrete aggregates, wallboard, paperboard, and other products that you'll find on any construction site.

The company also has an "oil and gas proppants" division that generates specialty sands and other materials used for hydraulic fracking.

Rising inflation naturally drives the price of materials like these higher. And that helps EXP investors in two ways.

First, EXP's profits will rise as the company can charge higher prices for the products that it sells. Wall Street analysts currently expect EXP to generate $9.34 in earnings per share next year, an increase of 17% over last year's profits.

Second, the value of EXP's resources will also increase whether the company actually sells these products in the near future or not.

This is similar to the way the value of your home rises even when you have no intention of selling it any time soon.

As investors, we have a claim to the company's immediate profits and the company's underlying assets.

So shares of EXP should continue to trade higher as both profits and the value of EXP's resources are driven higher by inflation.

Shares of EXP continue to hit new 52-week highs. I wouldn't worry too much about buying at the high, because rising inflation should continue to drive this stock steadily higher.

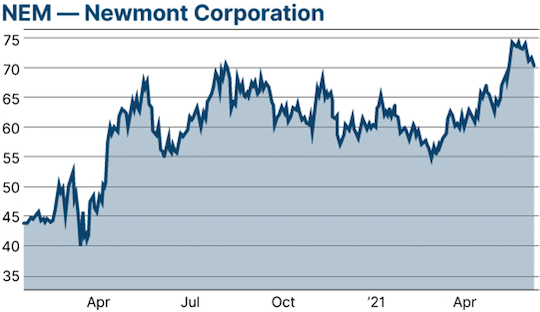

Inflation Buster #3: Newmont Corp. (NEM)

Precious metals like gold and silver have traditionally offered investors a great way to protect against inflation.

Critics will tell you that gold prices only match the rise of inflation over time. But during periods of higher inflation, gold and silver prices will naturally surge higher.

And then of course we see them pause or pull back during seasons when inflation is lower.

Since we're heading into a period with much more inflation risk, I recommend holding more gold and silver exposure than normal.

And in addition to holding physical gold and silver, it makes a lot of sense to invest in companies that produce these precious metals.

That's why today I'm recommending shares of Newmont Mining Corp. (NEM).

The company produces roughly 8 million ounces of gold each year from its nine different mines spread around the world.

In addition to its producing mines, NEM also has more than 20 development projects that will produce gold and silver in the future.

Much like our investment case for EXP, Newmont has two ways of helping your retirement account beat inflation.

First, the company's profits will naturally grow as inflation drives the price of gold higher. Wall Street analysts are currently projecting a 32% increase in profits over the next year. And that projection should increase as gold prices break out.

Second, the value of NEM's underground gold reserves will increase as the price of gold responds to inflation. And whether the company taps into those underground reserves or not, you can still profit!

That's because NEM's share price will rise to reflect the value of the company's holdings. And we're already seeing the stock move higher in response to inflation concerns.

Meanwhile, shares of NEM currently pay you a 3.1% dividend yield. That income can help you cover growing retirement expenses while still helping you grow your wealth at a much faster rate than inflation.

Remember, while all three of these stocks have moved higher in recent months, the risk of inflation is just getting started.

I expect the trend to continue, which means it may be a long time before these stocks pull back in any meaningful way.

So don't wait too long to start investing in these inflation busters.

After all, your retirement expenses are already surging higher as inflation spreads across our economy.

Here's to building your rich retirement!

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King