![Buy Alert: These Stocks Did NOT Sell Off [CHARTS]](http://images.ctfassets.net/vha3zb1lo47k/4Pv3iraAhZd3DIgkaIkgPE/dfafd768af3ee8b5ad8909f78efb88a3/shutterstock_683985172.jpg)

Posted September 21, 2021

By Zach Scheidt

Buy Alert: These Stocks Did NOT Sell Off [CHARTS]

Remember the Sherlock Holmes story about the dog that didn't bark?

Holmes was able to solve a "who did it" mystery by noticing something that didn't happen and figuring out that the culprit must have been someone that the dog was familiar with.

Given the weakness we've seen in the market lately, it can feel like a crime has been committed.

And you might be wondering how to protect yourself and feel "safe" with your investments again.

Today, I want to show you three stocks that didn't sell off even with the broad market weakness.

This stability helps us see which stocks have the most strength today — and which stocks are most likely to move higher in the weeks ahead.

Let's take a look!

The "Reopening Trade" Is Alive and Well

While China's Evergrande crisis, along with a selloff in cryptocurrencies, took the wind out of speculative traders' sails, one area of the market seemed completely oblivious to the carnage.

I'm talking about reopening stocks — an area we've been focusing on here at Rich Retirement Letter.

Investors in travel and leisure companies weren't flustered by the market's selloff and decided not to panic. That's a great sign of relative strength. And that strength can give you more confidence investing in these stocks.

Think of it this way...

If a market selloff like we saw over the past week didn't phase these stocks, it's hard to imagine what could derail these investments!

So rather than try to pick a bottom and buy volatile stocks at a cheaper price, the more reliable way to grow your wealth is through stocks that continue to hold up when others move lower.

Travel and leisure stocks have been helped by what appears to be a peak in new delta variant covid cases.

And they're also boosted by extra spending money Americans have been able to save from the generous relief payments from the government.

I'm keeping a close eye on three specific areas of the reopening trade.

And after the show of strength we've seen so far this week, I'd recommend putting some extra investment money to work in these three categories.

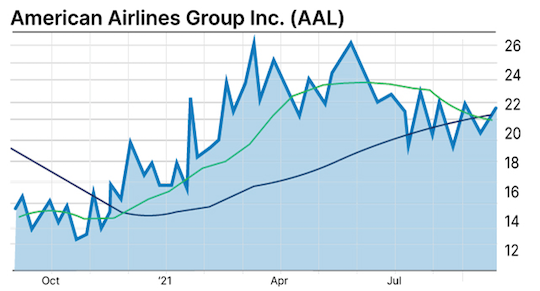

Reopening Basket #1: Airlines

Heading toward the 2021 holiday travel season, investors may have been concerned about the new delta variant canceling travel plans.

That's why airlines started to pull back a few weeks ago, giving up some of their gains from earlier in the year.

But now we're seeing early signs that the delta variant is peaking.

For airline stocks, it appears that investors have already anticipated the worst. That's why we saw these stocks move lower over the past few weeks.

From this point, any bad news should already be baked into expectations while any good news can propel these stocks higher!

Take a look at the American Airlines (AAL) chart below.

The stock barely budged on Monday when the overall market was weak.

As travel picks back up and investors gain more confidence in the overall economic reopening, shares of airline stocks should continue the rebound that started earlier this year.

AAL is by no means the only airline you can buy. But I wanted to show you this specific chart so you could see how certain stocks in this group are rebounding.

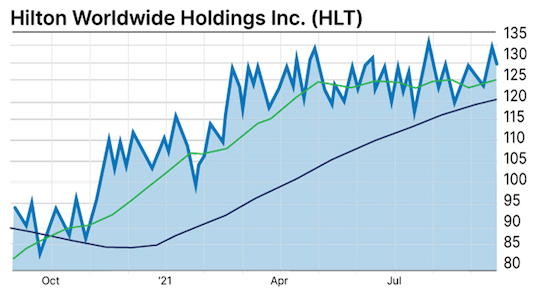

Reopening Basket #2: Hotels

Similar to the airlines, hotel stocks also held up quite well despite the market's pullback.

Here's a chart of industry-standard Hilton Worldwide (HLT)

The stock is trading very close to its all-time high despite concerns about the delta variant.

Any improvement in case numbers, travel restrictions or even news of corporations encouraging employees to travel again could be catalysts for this stock.

Pent-up demand for both personal and business travel should help hotel companies like HLT to book more reservations. And with higher demand comes higher prices. So expect a surge in profit margins as well!

Once again, this isn't the only stock you could pick in the group. But the chart for HLT above gives you a good idea of how strong this group continues to be.

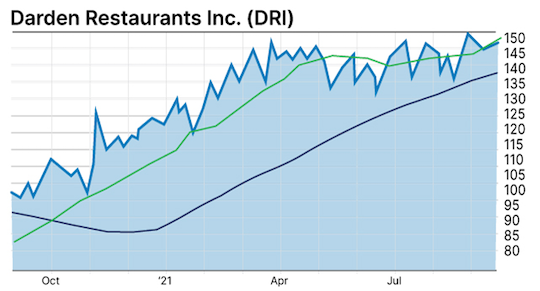

Reopening Basket #3: Restaurants

Finally, the restaurant stocks group continues to be a good place to hunt for investment opportunities.

You should use a bit more caution investing in restaurant stocks because some have survived this crisis period better than others.

But winning restaurant chains can help grow your wealth into the end of the year.

Look for companies that:

- Have been able to keep their operations humming...

- Have had access to the capital they need...

- And are now serving customers through both in-house dining and take-out offerings.

One of these stocks is Darden Restaurants Inc. (DRI).

The stock took an initial plunge when the coronavirus crisis hit.

But the company has adapted well to the new world that we live in. Profits are growing quickly and the stock is very near an all-time high.

I love the fact that shares of DRI hardly budged when the market sold off. The stability of this name should help to give investors confidence and lead to another surge higher.

So there you have it...

Three stocks in the travel and leisure area that are holding up well and have proven to be immune to the market's recent selloff.

I hope you're faring well during these dynamic times and look forward to helping you grow and protect your wealth!

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King