![[CHARTS] 3 Income Neighborhoods You Need to Live In](http://images.ctfassets.net/vha3zb1lo47k/6U9C3vuxwYUHuVYTRwBmMT/9b9b4f5b663436843d70e4baa454fd57/shutterstock_1049641082.jpg)

Posted November 12, 2021

By Zach Scheidt

[CHARTS] 3 Income Neighborhoods You Need to Live In

How is it already Friday?

Our Income Week here at Rich Retirement Letter has flown by and I can't believe we're already close to wrapping it up.

Before we wrap up Income Week, I want to share three important “income neighborhoods” in the market to help you find the very best plays that pay you the most reliable cash flows.

Why Some Areas Produce More Income

There are certain areas of the market that are notorious for paying great dividends. And other areas consistently underperform.

And then there are a few areas that are largely misunderstood...

(Quick pro-tip: Investing in misunderstood areas of the market can be extremely profitable, because once the truth becomes clear to everyone, stock prices can soar!)

The areas of the market that produce the most income typically have a few things in common:

- Companies are mature with experienced leadership teams.

- The products and/or services sold are in high demand.

- Profits are reliable in any economic season.

- Companies in these areas have stable financial structures.

These qualities can show up for companies in just about any industry. But certain industries are chock-full of great stocks that you can buy for income.

By focusing on these neighborhoods in the market, you'll have a much higher probability of locking in reliable income.

And you'll also be able to grow your wealth as these stocks trade higher!

Now let's take a look at three great areas of the income market.

Income Neighborhood #1: Financials

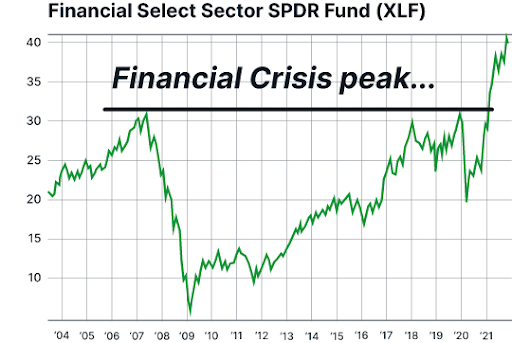

After the financial crisis, many of my clients swore they would never invest in a bank again.

I really can't blame them. After all, financial stocks took a severe beating and were supposed to be some of the safest (and income-rich) positions you could own at the time.

Mismanagement of these companies left a very bad impression on investors.

But since that time, the banking industry has cleaned up its act. Regulators are no longer asleep at the wheel. The companies have much more safety and many pay wonderful dividends that can give you plenty of cash for your investment.

Best of all, after more than a decade of trading below the 2008 peak, financial stocks have finally broken above that level.

This sets the stage for a strong run for these stocks.

It helps that interest rates are already starting to rise, which means banks can generate more profit by lending to companies that need capital as our economy recovers from the coronavirus crisis.

So if you're looking for reliable income plays to buy right now, consider adding bank stocks to your income portfolio!

Income Neighborhood #2: Energy

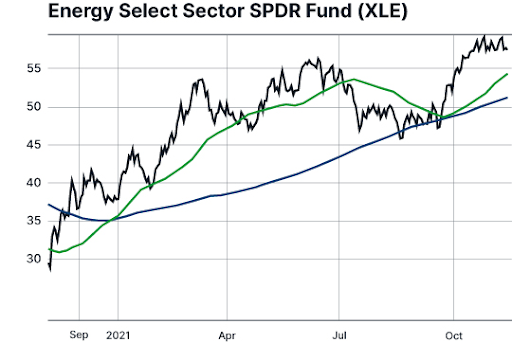

Over the last few years, energy stocks took a beating. I'm talking specifically about oil and gas companies tied to fossil fuel production and transportation.

Green energy initiatives have not only hurt profits for these companies. But trends toward environmental, social and governance (or ESG) investing have pressured stock prices as big investors look elsewhere for opportunities.

And while I love the idea of companies taking responsibility for these issues, that doesn't mean we can completely abandon traditional energy at this point in history.

We still need oil for the global economy to operate... for people to heat houses and get to and from work... for goods to be transported to our stores... and for many other important functions.

Oil prices shot higher this year thanks to strong demand and widespread underinvestment in new oil and natural gas wells. That sets up a great opportunity for energy investors!

Energy stocks have been trading steadily higher as you can see in the chart above. And many stocks in this industry pay very generous dividends!

You see, the energy industry sets the very definition of mature businesses. Many of these companies have been in business for decades and have already invested in all needed equipment and infrastructure.

Now, profits are rolling in. But these companies don't need to do anything with the profits.

It's a perfect scenario for income investors because these companies will continue to hand out more profits through dividend payments.

Income Neighborhood #3: Big Tech

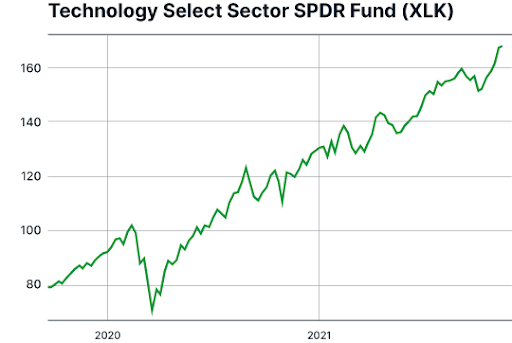

Technology stocks used to have a bad reputation with income investors. For years, these businesses (almost every single one) reinvested all profits in building out new areas of opportunity.

That's all well and good for growth investors.

But if you need income from your investments, it's hard to buy shares of a company that keeps putting its cash to work on new projects.

These days, the biggest and best tech companies have finally become great income payers as well!

This category of income stalwarts includes big names like Apple Inc. (AAPL) and Microsoft Corp. (MSFT) along with a handful of smaller companies too.

Tech continues to be a hotspot for investors. Just look at the run tech stocks have had over the last two years!

The tech area offers a great balance of growth and income. I love buying a stock that can help grow my wealth by trading higher, while also paying me income quarter after quarter.

Large-cap tech stocks offer both these features, making many of these stocks great all-purpose investments for your retirement.

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King