![[CHARTS] Here's What Happened During the Last Debt Crisis](http://images.ctfassets.net/vha3zb1lo47k/jdTX2uprbNEIwzT4yQ4oL/249ec31c58f5daf7f0dbaf5d92ac3822/shutterstock_769906846.jpg)

Posted January 20, 2023

By Zach Scheidt

[CHARTS] Here's What Happened During the Last Debt Crisis

Here we go again… The United States is facing another budget crisis.

With $31.4 trillion in debt, our government can't legally borrow any more money. Without adding more debt, we don't have enough money to pay for all of the government programs.

Treasury Secretary Janet Yellen announced yesterday the Treasury Department will start implementing "extraordinary measures" to rein in spending and keep the country from defaulting on its existing debt obligations.

That means less investment in existing government programs while lawmakers debate raising the debt limit and push our government closer to default. Sobering!

As we watch the embarrassing dysfunction in Washington, I want to make sure you understand the implications for your retirement.

More importantly, I want to help you avoid calamity while our inept lawmakers drive our country in a dangerous direction.

Check Out the 2011 Scenario

The last major debt problem like this was in 2011 when the U.S. came within 48 hours of defaulting on debt payments.

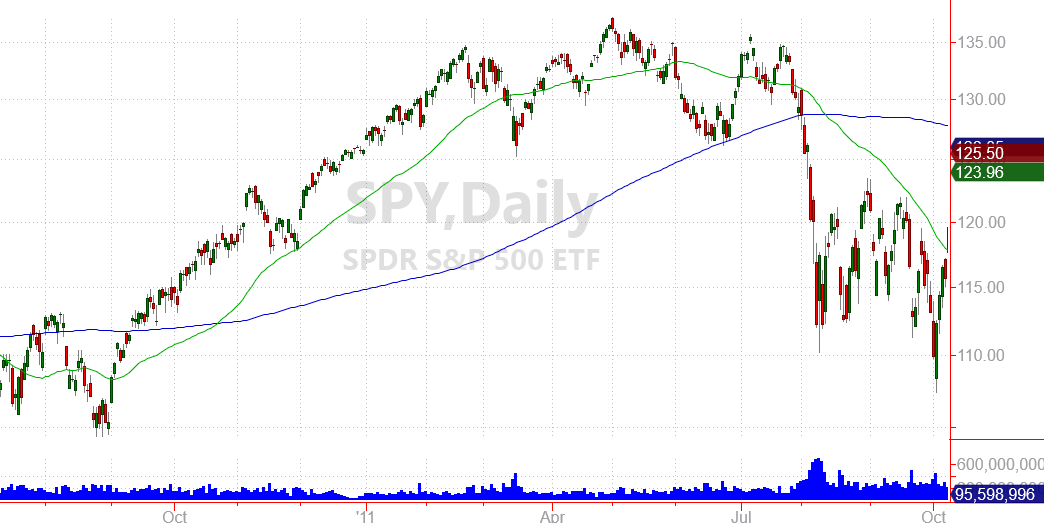

Here's what happened to the stock market…

The SPDR S&P 500 ETF fell from $135 to $110 in a matter of weeks, representing a 22.7% decline.

While the COVID crash may technically be the fastest bear market in history, the debt ceiling crisis wasn’t far behind.

It's sad to think that in just over a decade, our country seems to have forgotten the lesson from the last debt crisis.

This time it feels like Washington (and the American public) is even more fractured than before.

So it may take a lot longer for us to reach an agreement. Unfortunately, there may be a lot more pain in the market before we get there.

If you've been reading Rich Retirement Letter for a while, you know I'm not an alarmist or a fear monger.

While I do see plenty of opportunities to grow your wealth — even during this debt crisis — I still want to make sure you're prepared for the chaos that could be heading our way.

And there's one big asset class that could help you avoid losing money as lawmakers negotiate the debt ceiling.

The Irony of Safe Treasury Bonds

What I'm about to say next might sound counterintuitive, but stick with me for a minute.

The debt ceiling has the potential to keep the U.S. government from repaying some short-term Treasury bonds.

However, long-term Treasury bonds are some of the best hedges to help you avoid losses during the debt crisis.

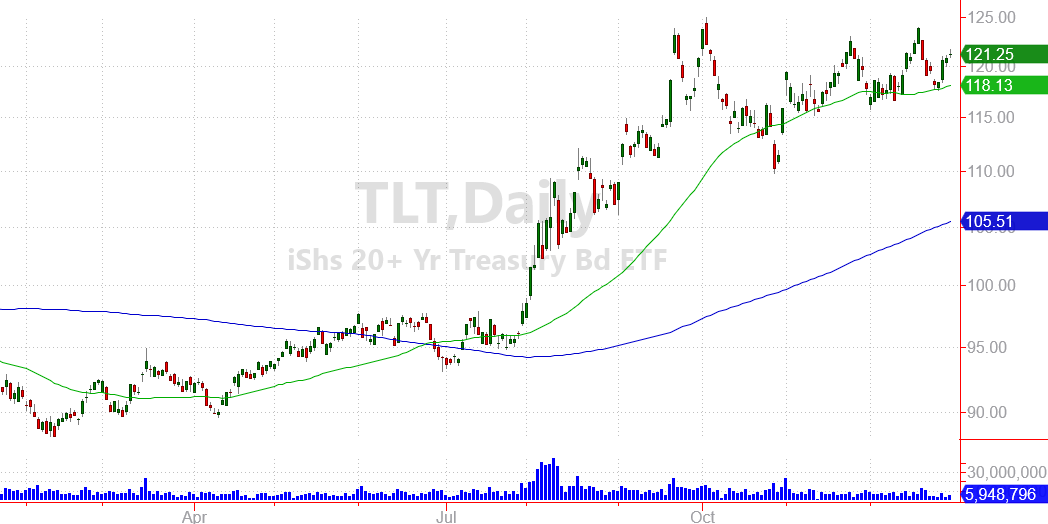

Take a look at how the i-Shares 20+Year Treasury ETF performed during the last debt crisis.

While stocks were falling, long-term Treasury bonds traded much higher. The ETF gained over 30%, more than offsetting the pullback in the overall market.

Bonds moved sharply higher because investors were looking for long-term safety.

And while they were worried about the government's ability to pay short-term bills, investors knew that eventually the government could print money to cover Treasury bond payments.

In other words, they were sure to get a nominal return, so capital flooded into long-term Treasury bonds.

What You Can Expect This Time Around

We know that history rarely repeats itself exactly. But as they say, it often rhymes. So what can we expect this year as our lawmakers play chicken with our country's finances?

My guess is that we'll see a similar rally for long-term Treasury bonds, which means you can buy shares of TLT as a hedge against a worsening debt crisis.

You may want to consider lightening up on some of your stock positions while keeping the high-quality names that generate reliable profits and pay healthy dividends.

Once you sell some of the more speculative names in your investment account, use the cash to buy Treasury bonds or shares of TLT.

If the market falls because of the debt crisis, you'll probably lose some money on your remaining stock positions. But those losses could be offset by gains from your Treasury bonds.

Meanwhile, if we avoid a debt crisis, your stocks will likely continue higher. But your bond positions should hold their ground.

That's because the U.S. will still repay its debts over time. So your bonds are in a relatively safe position even in this time of uncertainty.

Of course, there are other ways to protect your wealth, including precious metals and some other hard asset strategies.

We'll talk more about these alternatives in the weeks ahead as we get closer to the true drop-dead date for the debt ceiling.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King