Posted August 28, 2023

By Zach Scheidt

How the Pinch Stole Christmas

I can be a bit of a Grinch during the holidays if I'm not careful.

Don't get me wrong. I love the food, traveling to visit family, and spending quality time with my loved ones. But I hate shopping for holiday gifts.

Maybe it's because I'm a father of seven (yes, you read that right). The pressure of buying thoughtful gifts for so many kids can be a bit overwhelming sometimes.

But this year, I might not be the only Grinch in town…

Consumers are feeling the pinch a little more than usual heading into this year’s holiday season. And that means spending will be lighter than in previous years.

Of course, consumer spending levels will affect different areas of the market.

Today I want to share some warnings — along with ways to profit — as we wrap up summer and start looking forward to the holiday season.

3 Challenges for Retailers This Year

This year is shaping up to be a challenging one for retailers, thanks to three key factors I'm watching carefully.

First, consumers are prioritizing experiences over tangible goods. This is a trend left over from the pandemic.

After buying lots of “stuff” while cooped up, consumers are now more interested in paying for experiences like trips, attractions, or even dining out.

Last year, my family’s big gift was a trip to Colorado for my southern-born kids to see actual snow in the Rockies.

Data for the upcoming holiday season shows that many families will be focusing on similar gifts this year.

A second concern is the resumption of student debt payments. And this could take a major bite out of discretionary spending this fall.

Unless a new reprieve is granted, student loan payments will resume in October, affecting nearly 44 million Americans.

These borrowers collectively owe more than $1.6 trillion, so this will certainly cause a drag on household budgets and sentiment as families worry about these long-term liabilities.

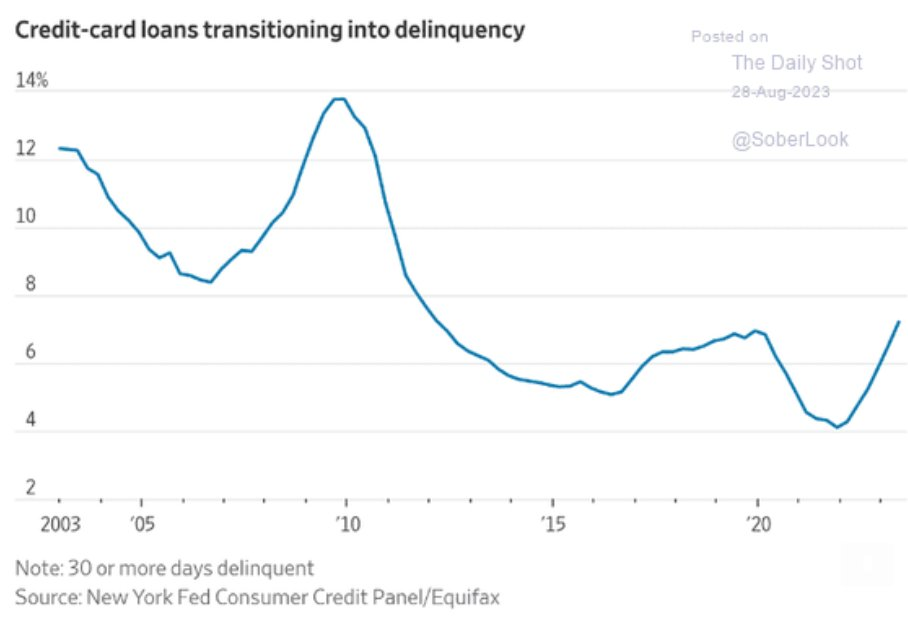

Finally, we're seeing a pickup in credit card delinquency rates. And this is a major concern for both retailers and the financial institutions that issue these revolving loans.

I highlighted this on my Twitter feed this morning. As you can see in the chart below, this trend may just be getting started as financial conditions get more challenging.

These three factors don't include the one other elephant in the room for store owners…

The growing threat of "shrinkage" (or more accurately, theft) is making it even more difficult for brick-and-mortar retailers to grow profits in our challenging cultural and financial environment.

It's Not Too Early for Holiday Trading

The stock market tends to look ahead toward both risks and opportunities. As traders see key themes emerging, they place bets ahead of the headlines.

This way when the news comes out and a trend becomes obvious to everyone, shrewd traders already have their bets placed.

As we work to grow and protect your retirement wealth, I'd like you to consider some plays that could profit from disappointing retail sales this holiday season.

The best way I know to do this is to buy in-the-money put contracts on key retail stocks before the companies announce weak holiday spending.

I've got my eye on a few vulnerable stocks and will likely set up some new aggressive trades over the next few weeks.

These plays can profit as retail and financial stocks trade lower, which could give you some extra cash to spend over the holiday season!

I'm excited about the profit opportunities in front of us right now. (And I promise to try my best to be less of a Grinch this holiday season.)

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King