Posted December 02, 2021

By Zach Scheidt

How to Handle the Market Plunge

"We’re getting slaughtered out here. Things are not looking good!"

Yesterday, I checked in with an old friend and colleague of mine.

Paul and I worked together years ago. And while I was driving home from vacation with the family, I decided to check in on him.

Of course, I kept up with the market action while taking the kids to Universal Studios. But I wanted to get Paul's reaction to the market's recent pullback.

(To be perfectly honest with you, I needed the entertainment on the drive home. And I knew that Paul wouldn’t disappoint.)

While Paul's reaction may have been a bit dramatic, I want to spend some time today helping us think through the best way to respond to the recent volatility in the stock market.

This Is NOT a Terrible Market Selloff

Watching the market action (and the reaction by traders) can be a very interesting study on human psychology.

To hear Paul's panicked assessment of the market, you’d think that the overall stock market was in a freefall.

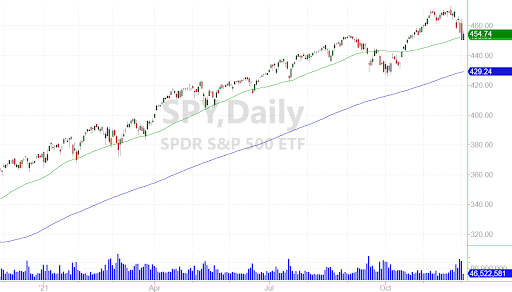

In reality, this looks very much like a run-of-the-mill pullback for stocks. Just take a look at the chart of the S&P 500 ETF below.

As you can see, the market pulled back to its 50-day moving average line, which is near the same spot where the market broke to a new high in mid-October.

In other words, the market is at a level that caused investors to cheer just six or seven weeks ago. But our perspective has shifted thanks to a couple of weeks of higher stock prices.

Now I'm not making light of the losses my friend Paul may be suffering through. But it's important to see that this isn’t a situation that should cause investors to panic.

Instead, this pullback gives us a healthy opportunity to reassess which stocks we’re invested in and make any adjustments necessary to keep a balanced approach to the market.

Sell Your Losers and Add to Your Winners

One of the most valuable lessons I got from my boss and mentor Bill was posted on our break room bulletin board.

The 3x5 Index card featured this simple handwritten statement:

“If it's working... BUY MORE!!”

Bill would come into my office and repeat the statement to me at least once a week. And whenever we reviewed my investment positions he would always say the same thing...

"Zach, you need to get rid of the positions that aren't working for you. And you need to buy more of the investments that are profitable!"

It's a concept that sounds elementary. But despite the simplicity, Bill's wisdom really does work!

It's helped him create a track record that grew and protected the wealth of his affluent clients.

And the concept has helped me grow my family's wealth (and hopefully your wealth since you're part of Rich Retirement Letter).

Let's take a quick look at what's working in today's market and what areas you need to avoid.

Speculative Tech Under Pressure

Maybe my friend Paul was getting slaughtered because he was invested in the wrong areas of the market.

Right now, the most speculative tech stocks are under significant pressure.

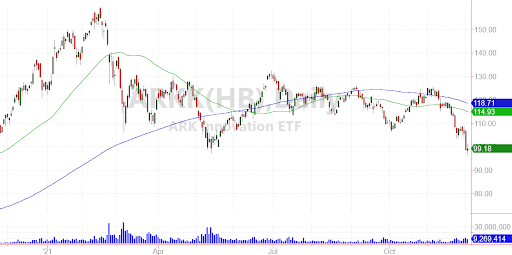

To get a feel for how these stocks are trading, take a look at the ARK Innovation ETF chart below.

As you can see, this group of stocks has been trading lower for some time now.

And since many of the companies included in this fund have yet to generate a profit, the entire group could continue to trade lower for quite some time.

If you have a large portion of your investment account tied up in stocks with no current profits, I would suggest closing some of these positions for now.

These stocks may eventually trade higher. But it may take a long time before they recover.

And in the meantime, you're missing out on opportunities to grow your wealth with stocks that are working now.

Semiconductors Are Still Surging

Even though speculative tech stocks are trading lower, that doesn't mean you can't make money from other technology stocks.

You just need to focus on companies that are actually making money — a novel concept to many speculative investors.

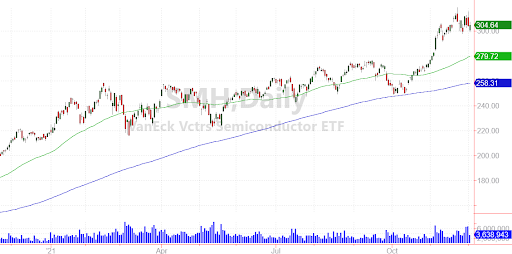

Shares of semiconductor stocks have held up very well despite the market's recent selloff. Just look at the Semiconductor ETF (SMH) chart.

Semiconductor stocks are trading very close to all-time highs. It's as if the group is completely immune to the recent pullback for the rest of the market.

Taking Bill's wisdom to heart, this is one of those areas that is working. So according to Bill, you should be buying more of these stocks.

These two charts are just a couple of examples of the difference in how specific stocks are trading.

By taking a look at the winners and losers in your account (and your watch list) you can quickly figure out which areas to add to and which to avoid.

Remember Why You're Investing

Before I sign off, I’d like to offer up one quick reminder.

My goal here at Rich Retirement Letter is to help grow your wealth so you can focus on the things that really matter in life.

Over the past few days, I took some time off the desk to spend with my family.

For my twins' 13th birthday, we drove to Orlando Florida and visited the Universal Studios theme park.

I'm grateful for the chance to make memories with the kids. And I hope that they'll look back on their childhood and remember how much their dad loves them.

For me, that's what really matters: spending time with loved ones and making memories.

What matters to you may be similar — or it may be different. Maybe you're growing your wealth so you can enjoy financial freedom. Or maybe you have a cause or a charity you want to give to.

What really matters is a very personal topic for each of us.

But regardless of what matters to you, my team and I here at Rich Retirement Letter are dedicated to helping you protect and grow your wealth so you can focus on what's important to you.

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King