Posted April 29, 2022

By Zach Scheidt

It Hasn't Been This Bad in 15 Years!

I did a double-take when I saw the chart I'm about to show you.

I thought to myself, “Are things really this bad?”

As the stock market adjusts to a new environment of high inflation and rising interest rates, investors are becoming more pessimistic.

Today's chart shows you how extreme this pessimism has become.

But believe it or not, that can be good news for your investments. Let me explain why...

Investors Haven't Been This Pessimistic in Years

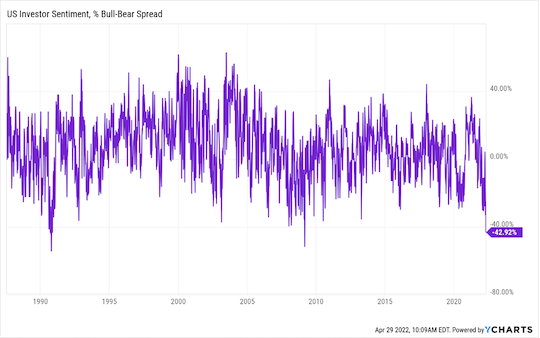

Take a look a the chart below. This indicator measures the number of investors who consider themselves bullish compared to the number who are more bearish on the market.

Basically, the lower the reading on this chart, the larger the number of investors who expect stocks to trade lower.

Thanks to the market's recent decline — and the absolute carnage for some of the most popular tech stocks — investors are feeling more pessimistic than we've seen in years.

You’d have to go back all the way to the financial crisis to find a time when there were more bearish investors.

I remember those days well. Back in 2008, I took a trip to New York to meet with some of my Wall Street contacts.

I distinctly remember sitting at a Starbucks across the street from one of the major investment banks and watching people file out of the building carrying cardboard boxes.

These professionals were losing their jobs by the hundreds thanks to the financial crisis and the market meltdown.

So does the chart above tell us that we're in for the same type of situation this time around? Not so fast...

Sentiment As a Contrarian Indicator

The ironic thing about the above indicator is that it usually points in the opposite direction from where the market is headed — at least in the near term.

That's because when most investors have already made up their minds to be bearish, these investors have already sold most of the investments that they're willing to part with.

In other words, the damage has already been done to the broad market.

So we probably won't get much of a reaction in the market because investors have already sold.

At the same time, if there is any good news for the market, these bearish investors can be caught off guard and out of place.

Imagine the frustration of getting out of the market when you think things are bad only to watch stocks start moving higher.

Many of these investors now have cash sitting on the sidelines. And once the market starts trending higher, they'll suddenly get FOMO (or fear of missing out).

That's why this sentiment indicator is such a great contrarian indicator.

Because when people are too pessimistic, there’s money on the sidelines to buy.

And conversely, when people are too optimistic, all of the money is already in the market and there is less buying power to keep pushing stocks higher.

Using Sentiment Swings for Profit

If you want to be a successful investor over time, you've got to be in control of your emotions…

Look at the market more rationally…

And learn to take advantage of the swings the market (and the sentiment of other investors) give you.

Right now, the statistics are telling us that there's a strong probability of a market bounce.

Buying shares of quality companies that have traded at unreasonably low prices is a great way to capitalize on this setup and profit from a rebound.

We'll still be monitoring risks in the market. And I still want you to steer clear of speculative tech stocks with little or no earnings.

But this market looks like it is setting up for a tradeable rally — at least for the next few weeks.

Let's use that bounce to book some of your profits!

Here's to living a Rich Retirement!

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King