Posted January 20, 2022

By Zach Scheidt

Make Microsoft's $26 Billion Secret Weapon Work for YOU!

Did you see the blockbuster buyout news this week?

Shares of video game maker Activision Blizzard (ATVI) vaulted sharply higher on Tuesday morning when news broke that Microsoft Corp. (MSFT) agreed to buy out the company.

ATVI closed last week at $65.39. But when the market opened following the long holiday weekend, the stock jumped to an opening price of $86.77.

That's nearly a 33% jump over a single weekend!

I'm happy for investors in ATVI who profited from this announcement. But the real winner in this situation is Microsoft.

Today, I'll explain why this deal makes so much sense for the blue-chip software company.

And more importantly, I want to show you how Microsoft's secret buyout weapon can work even better when you put it to work in your investment account.

How Microsoft Picked Off an Easy Buyout Target

When the Activision buyout news hit the tape on Tuesday morning, it seemed like every financial media personality had to weigh in on the deal.

Reporters lauded the company's bold offer while strategists talked about the long-term synergies and renewed growth prospects the deal brought to Microsoft.

All of those things may be true. And I'm excited to see how the two companies integrate over the next several years.

But there's one major point that the financial media completely missed in their assessment of this deal… a point that’s especially relevant to investors like you and me.

I'm talking about the way that Microsoft pulled off this $70 billion deal.

There are two main points you need to understand when it comes to the power of this buyout deal.

First, Activision as a company has been in trouble for quite some time. Even though the games ATVI creates are very popular with customers, the stock moved sharply lower as investors reacted to scandals uncovered with the company's ethics and culture.

Over the past year, shares of ATVI lost nearly half of their value from the 2021 peak to last month's low.

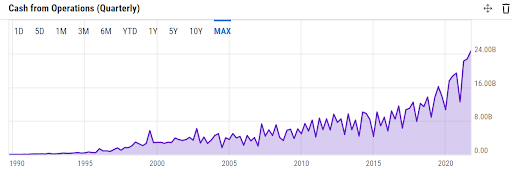

The second point to pay attention to is the financial strength of Microsoft. In particular, I'm impressed with the amount of cash that MSFT generates year in and year out.

Last quarter alone, the company generated $24 billion from its business operations.

Just take a look at the quarterly cash flow for MSFT in the chart below...

(Incidentally, this is why MSFT is one of the core holdings in my Lifetime Income Report dividend newsletter. The company churns out so much cash that they can afford to be generous to investors with reliable dividend payments!)

Reliable Income Lets You Capitalize on Unreliable Opportunities

I consider Microsoft's income a "secret weapon" of sorts when it comes to the company's competitive advantage.

By generating plenty of income quarter after quarter and allowing that income to accumulate for years, Microsoft was in the perfect place to take advantage of a great opportunity when it came around.

As a $2.2 trillion company, Microsoft has a limited number of opportunities that can really move the needle for its business.

It takes a giant buyout deal to make a big enough difference in the company's long-term profits to be worth the effort.

And those giant deals don't come along every day.

So when Activision lost nearly half of its market value, Microsoft's management team did a good job of recognizing the opportunity and getting ATVI's board to the negotiating table.

More importantly, MSFT built up a huge war chest of cash so it would be ready when a new opportunity emerged.

Some say it was lucky that Microsoft happened to have the cash ready to scoop up ATVI when the stock dropped so sharply.

I like the saying "luck is when opportunity meets preparation." And Microsoft was certainly prepared thanks to the income it has been diligently saving for the last decade.

Use Income in Your Portfolio to Capitalize on YOUR Opportunities

I get excited when I see a deal like ATVI announced.

Not because of the overnight gains in the stock. It's more about the opportunities that you and I have to put our income to work in the market.

Think about this for a second...

Microsoft got a good deal for the Activision buyout. But it didn't get a great deal.

Since Microsoft was buying out an entire company, they had to offer enough cash to convince the board to agree to a full-on buyout.

And the cash deal had to be enough to convince existing investors to vote in favor of the buyout.

That's why MSFT had to offer a premium price to where the stock was trading last week. And that's why the stock jumped so much on the announcement.

Since you and I aren't buying out entire companies, we don't have to pay the same sort of premium. Instead, we can buy a few shares of any publicly traded company at the current market price.

That gives us as individual investors a wonderful advantage. And it's why I love investing for income in today's market.

You see, if you buy dividend stocks or use my favorite put-selling strategy to steadily collect income from the market, that income will accumulate in your brokerage account.

Week after week, month after month, you'll accrue more and more cash in your account.

Then when new opportunities emerge (like the sharp decline for ATVI's stock) you'll be sitting on a pile of cash you can use to take advantage of the discounts the market inevitably offers.

Whenever quality stocks drop by significant amounts, you'll have the option to buy them with the cash you've accumulated.

Unlike Microsoft, you won't have to pay a huge premium to take advantage of the special deal. But just like the blue-chip software giant, you'll be able to parlay your income into a new opportunity.

That's how true wealth is compounded over time. And it's a perfect way to combine a steady income investing strategy with a more aggressive and opportunistic buyout approach.

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King