Posted March 03, 2023

By Zach Scheidt

My Favorite Play for Energy Income

"Hey Dad, can I have some gas money to get back to school?"

After a memorable family vacation last week, it was time to return to real life at the Scheidt house.

And that meant my 20-year-old daughter needed to drive back to her out-of-town college.

Despite her fuel-efficient vehicle, it still took a chunk out of her budget to drive all the way home so she could join us on our trip.

I'm grateful she made the effort to be with us. So I was happy to give her some extra gas money for her trip back to school.

But wow, these trips back and forth are really starting to add up with gas prices so high! Let's look at what's going on in the charts below...

A Dislocation in America's Energy Market

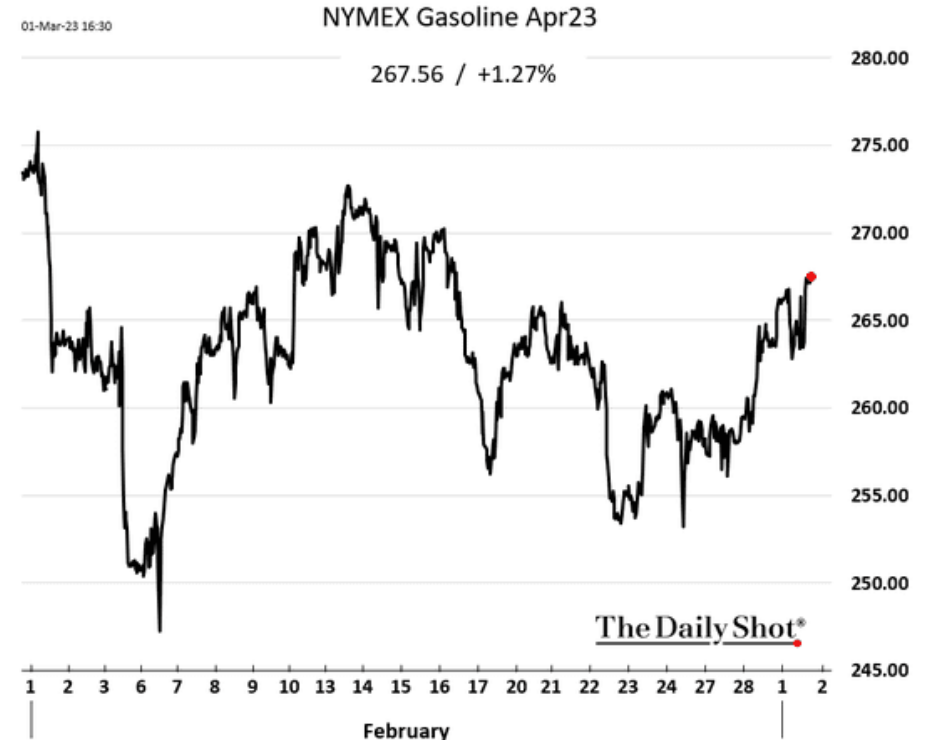

Take a look at the chart for gasoline prices below. You can see that the price of gas is already rising, and we're not even close to entering peak driving season here in the U.S.

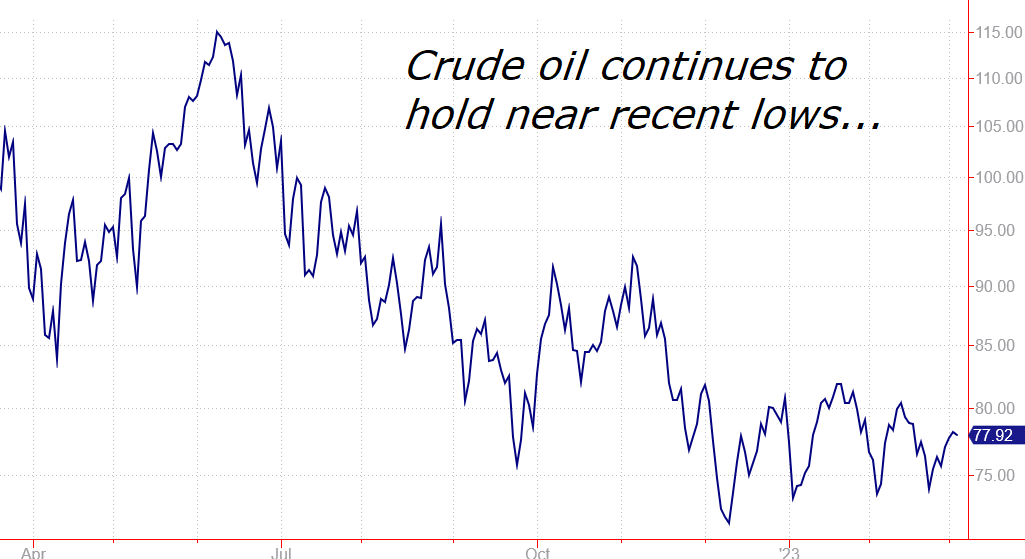

If you follow financial markets closely, this surge may come as a surprise to you. After all, crude oil prices have been in a holding pattern so far this year.

So why would gasoline prices be moving higher?

The answer has everything to do with the process of converting oil into useable products like gasoline, diesel fuel, and jet fuel.

And with oil prices and gas prices out of balance, there's a unique opportunity for income investors.

Oil Refiners Enjoy the Best of Both Worlds

You can sum up today's energy market by connecting a few simple data points:

Low Oil Prices + Rising Gasoline Prices = High Refining Profits

The current market is perfect for crude oil refining companies.

Refineries typically buy oil at spot prices. Today that means the refiners can get oil for less than $80 per barrel.

Crude oil is then refined into useable products like jet fuel, gasoline, kerosene, and other petroleum-based products.

Depending on the grade of oil, each barrel typically produces 19 gallons of gasoline, 12 gallons of diesel fuel, 2.6 gallons of jet fuel, and an assortment of other products.

Here's a helpful graphic that shows the breakdown.

One of the problems in today's economy is that demand for these different products doesn't always match up to the ratios of what’s produced from each barrel.

So there are times when refiners produce too much diesel but not enough gasoline. Plenty of rubber and asphalt, but not enough jet fuel. And so on.

While there's a reasonable amount of crude oil available to refiners today, inventories of jet fuel and gasoline are low, especially in certain parts of the country.

This creates a unique profit opportunity for refiners. These refiners can buy crude at cheap prices and then sell the most important refined fuels at higher prices.

And this creates an extremely lucrative environment for oil refiners.

Tapping Into a Refiner Income Play

There are several profitable refinery companies in today's market. With so much profit in the industry, I'm keeping tabs on several high-quality investments.

One play that may fit perfectly in your retirement account is Phillips 66 (PSX).

The company operates 12 different refineries capable of processing two million barrels of oil per day.

PSX also owns a network of pipelines, which help the company efficiently distribute its refined products to customers across the country.

Thanks to high refinery profit margins, PSX is expected to generate profits of $13.93 per share this year.

And if the split between crude oil prices and refined fuel prices continues to diverge, this estimate could turn out to be far too conservative.

Meanwhile, PSX pays investors a quarterly dividend of $1.05 per share. That gives you a yield near 4% if you buy shares today.

And with profits accumulating, I expect PSX to either increase its dividend or buy back shares, which would add even more value to your investment.

On Monday we talked about how share buybacks can be very helpful in growing your retirement wealth. You can review Monday's article here.

Consider adding PSX to your retirement account today. The income you receive from this high-profit energy play could help offset higher gasoline prices to fill up your car.

And depending on how much you invest, your profits could even cover the jet fuel for your next flight!

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King