Posted December 21, 2022

By Zach Scheidt

My Top Investment Prediction for 2023

It’s certainly been a difficult year for investors. A few of the dominant topics in 2022 were inflation, which failed to abate and instead rose to 40-year highs…

The outbreak of war in Europe that added volatility to the market and disrupted exports of oil, natural gas and wheat from Russia and Ukraine…

And stocks selling off in response to the pressure, ultimately pushing each of the major stock market indexes into a bear market.

I could go on. But I’m sure you don’t need me to remind you just how challenging the past 12 months have been.

Instead, I’d like to focus on the opportunities that lie ahead by sharing my top investment prediction for 2023, which pertains to the price of gold.

Gold is one of the ultimate safe-haven investments, which is why it’s considered an essential component of any investment portfolio.

In good times, the yellow metal is a store of value, offering immunity against the monetary inflation that silently robs your spending power.

During times of economic stress and heightened uncertainty, gold prices can suddenly surge higher, offering you a chance to sell some of your precious metals for huge profits.

You’d think that a safe-haven asset like gold would have soared in 2022 given the majorly disruptive events of the year. But that didn’t exactly happen.

As of early December, an ounce of gold is priced at just under $1,800, basically where it started the year. I believe, however, that changing economic conditions will allow gold to soar in 2023.

I predict that the price of gold will reach $3,000 an ounce within the next year.

If you’re a longtime reader, this may sound familiar. I’ve gone on record before with a similar price prediction about gold.

Before I explain why gold will soar in the year ahead, allow me to first address why my last gold price prediction didn’t play out as I expected.

What Happened to the Last Gold Breakout?

Two years ago, I predicted that gold would push above $3,000 an ounce sometime in 2021, primarily due to inflationary pressure.

At the time the Federal Reserve was pouring money into the economy with no end in sight. I forecasted that this would cause serious inflation, which would raise the price of gold.

Simple enough, right? Well, only half of my prediction came to pass.

Inflation would soon become a front-and-center issue both on Wall Street and in Washington. And we all felt the effects on a personal level.

Consumer prices climbed higher month after month, notching multi-decade highs in 2022. The price of gold, however, barely budged.

So what gives? There are two primary reasons why this happened...

The first is the strength of the U.S. dollar.

Although inflation did rise as we predicted, the U.S. dollar held up better than other global currencies like the euro, yen or pound.

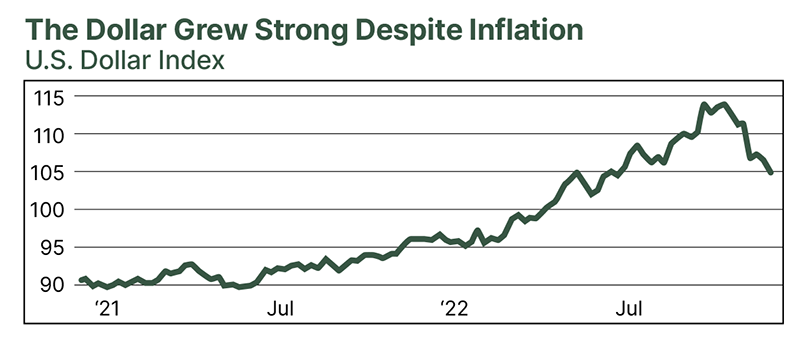

Below you’ll see a chart of the U.S. Dollar Index, which tracks the relative value of the dollar against a basket of other important world currencies.

As you can see, the dollar gained strength for nearly two years after our 2021 gold price prediction. And a strong dollar can keep prices of commodities like gold in check.

In other words, gold and the dollar typically have an inverse relationship. The stronger the value of the U.S. dollar, the lower the price of gold.

So that’s one of the reasons why gold didn’t take off as we originally predicted.

The second is the rise of crypto as an alternative investment.

Bitcoin and other cryptocurrencies exploded in popularity over the past two years. Again, this happened not long after we published our last gold investment forecast.

One of Bitcoin’s major selling points is that it’s designed as a sort of digital gold. Like physical gold, there’s a finite number of bitcoins that can be issued.

When the reality of inflation started to set in, many people (especially young investors) parked their cash in crypto expecting it to work as an inflation hedge.

That’s money that otherwise could have gone into gold. And lowered demand for gold while investors looked elsewhere also kept prices low.

Either one of these trends on its own could have disrupted our original prediction.

But combined, they essentially acted as a headwind that prevented gold from making any sustained progress — even during a period of record inflation.

Now allow me to explain why that’s all about to change…

Gold Will Finally Hit $3,000 in 2023

Although it’s had its ups and downs, gold is on track to end 2022 right around where it started (and not too far from where it began the previous year, for that matter).

But the headwinds that kept gold stagnant for so long are changing direction, which means the yellow metal can finally take off.

To start, the U.S. dollar is beginning to lose some of its strength.

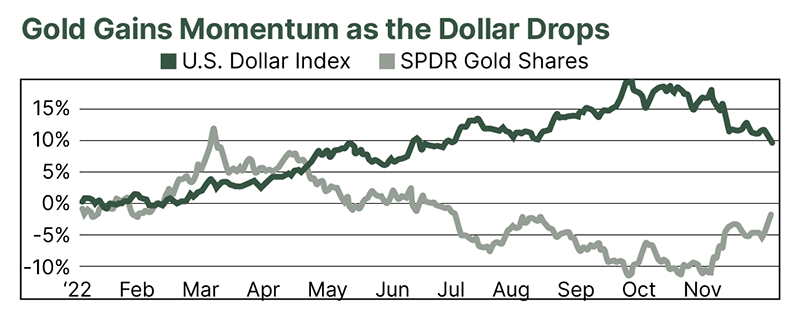

Remember that the price of gold and the value of the U.S. dollar have an inverse relationship. When one sees a trend shift, the other will often move in the opposite direction.

You can see this reversal begin around late September in the chart below.

Gold is often referred to as a "stateless currency" that investors turn to when they lose faith in a traditional currency like the U.S. dollar. So as the dollar weakens, gold is now more attractive.

Meanwhile, cryptocurrencies have also lost much of their appeal.

Bitcoin’s dramatic price swings over the past few years indicate that the digital asset may not be a stable long-term store of value like some had hoped.

That’s not to mention individuals and institutions alike are second-guessing the industry’s overall outlook after the FTX bankruptcy scandal.

Those dollars are now moving out of crypto and back into more traditional precious metal investments, helping drive the price of gold higher.

Keep in mind that we’re in the early stages of both shifts, which means the gold rally is just getting started.

And as we’ve discussed at length, inflation isn’t going anywhere. When inflation runs as high as it has this past year, it often takes several more years to return to normal.

This is all to say that the backdrop for gold is very strong, especially now that the headwinds working against it have finally died down.

That’s why I believe gold prices are well on their way to $3,000 an ounce before the end of 2023.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King