Posted May 22, 2023

By Zach Scheidt

Profit From the "Dividend Catch-Up" Trade

Technically speaking, the stock market is up so far this year. But it doesn't feel that way to most investors.

That's because while the large-cap market indices are pushing higher, most American stocks have been treading water.

How can this be?

They say the devil is in the details, and this is certainly true if you look closely at stock market returns this year.

Almost all of the market's gains have come from a handful of the largest companies on Wall Street. I'm talking about names you'll certainly recognize like Apple, Microsoft, Alphabet and Meta.

These mega-tech companies have a huge influence on market indices like the S&P 500 or Nasdaq 100. But smaller companies barely move the needle for large-cap indices.

Bottom line, many areas of the market have been left behind over the last few months.

The good news is that as these stocks play catch-up to the rest of the market, you have an opportunity to lock in some huge profits!

The “Dividend Stock Catch-Up" Trade

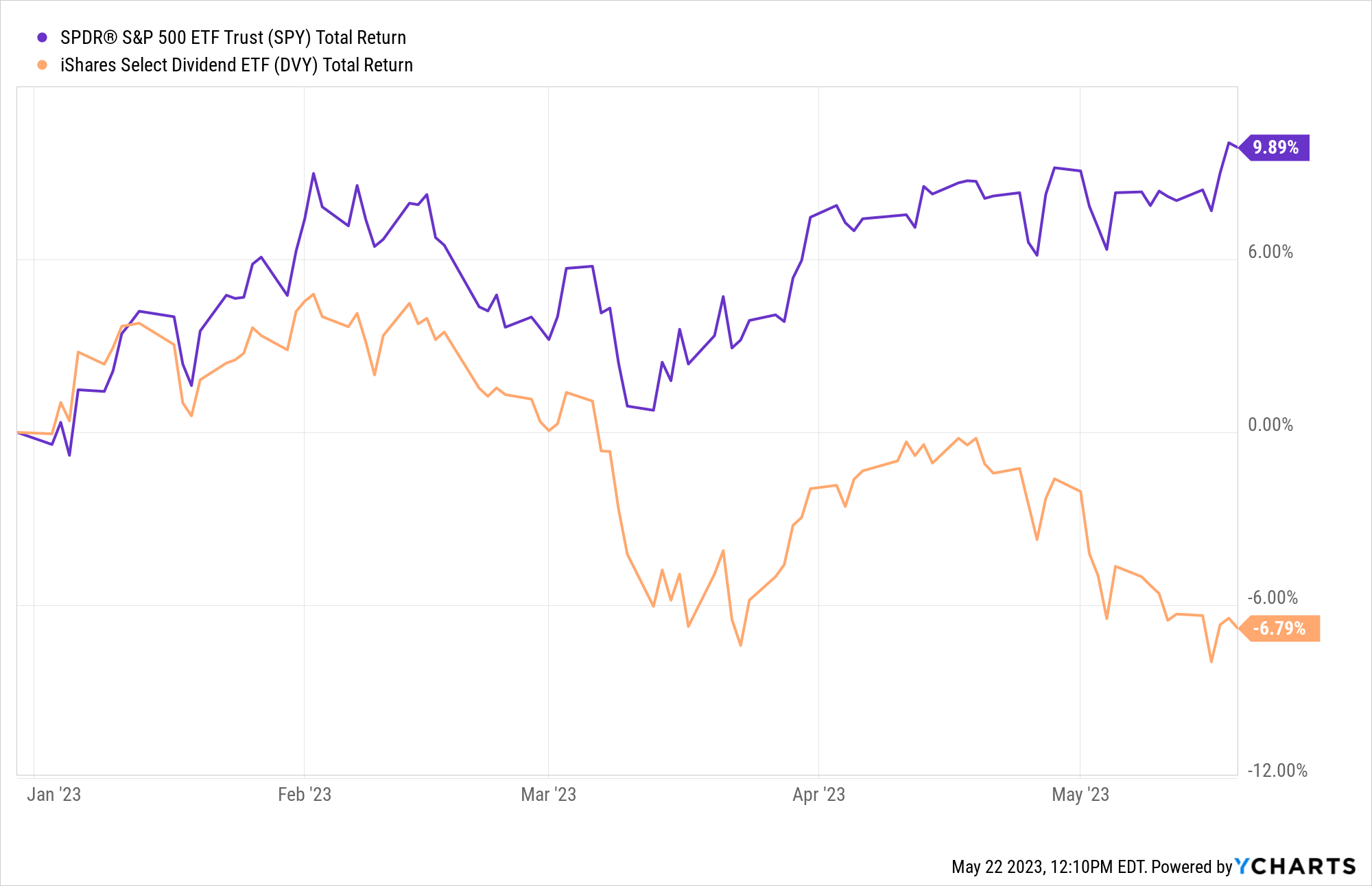

Take a look at the chart below. It shows the broad S&P 500’s performance this year (purple line) and the performance of a basket of dividend stocks (orange line).

Unfortunately, dividend stocks are trailing the broad market by more than 16 percentage points so far in 2023. And we're not even halfway through the year!

But while this is certainly disappointing, the chart also has a silver lining…

You see, dividend stocks have been lagging the broad market. But that doesn't mean there is anything wrong with the companies that pay dividends.

In fact, many of these companies are healthier than they were at the beginning of the year, thanks to growing profits and higher cash balances.

So even though stock prices have been pulling back, the actual value from investing in these companies is increasing. So you're getting more for your money in the long run.

I don't expect this underperformance to last long.

Historically, dividend stocks have posted much stronger total returns than stocks of companies that don't pay dividends — especially when you factor in the higher risk for the more speculative non-dividend-paying stocks.

So as we head into the summer, I'm expecting these dividend stocks to rebound and turn in a better performance than the rest of the market.

Building a Dividend Stock Shopping List

The orange line in the chart above shows the total return of the iShares Select Dividend ETF (DVY). This is a fund that invests in many of the best American dividend-paying companies.

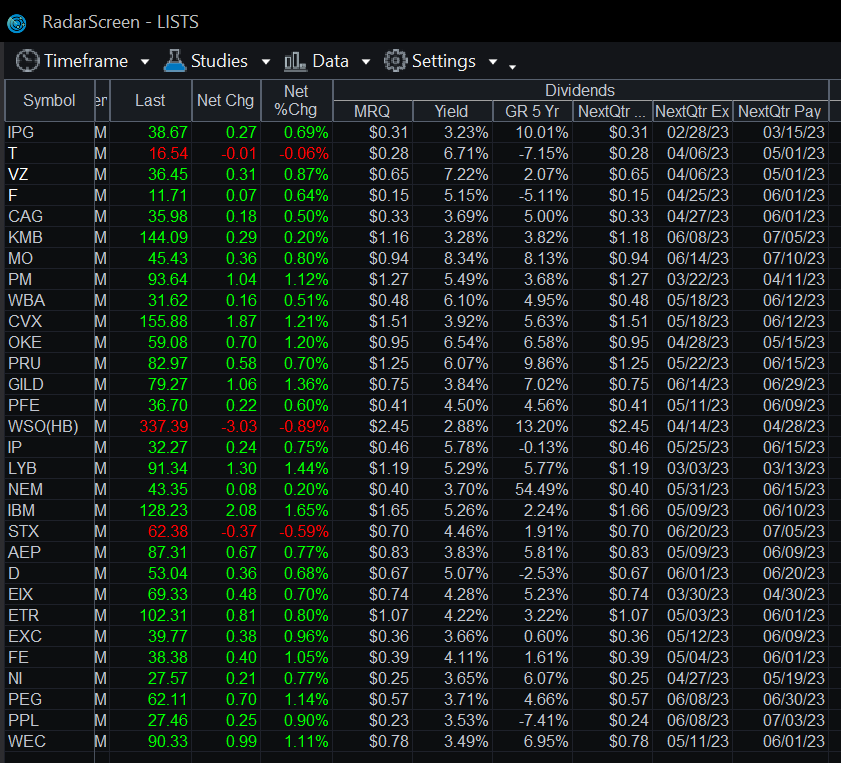

Over the weekend, I pulled a list of the top stocks included in this fund and started researching which stocks make the most sense for you.

First, here's a screenshot of the top holdings in DVY along with some yield statistics for each stock:

Here are a few standouts that caught my attention:

- Chevron Corp. (CVX) pays a 3.9% yield. The stock pulled back alongside weak crude oil prices this year. But oil is finding support and CVX has plenty of cash and profits to continue growing its dividend over time.

- Philip Morris International (PM) pays a 5.5% yield. The company is diversifying away from its traditional cigarette business and is a natural beneficiary of the falling U.S. dollar.

- Newmont Mining (NEM) pays a 3.7% yield. The gold miner will book larger profits thanks to higher gold prices, leaving plenty of room for larger dividends in the future.

Many other stocks on this list also look very attractive, especially in today's market where dividend stocks have been left behind even though the companies still pay lucrative dividends.

I'm excited about this list of reliable dividend stocks.

And I'm looking forward to a very profitable period as these stocks play catch-up to the rest of the market — giving you both income and investment gains for the rest of the year.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King