Posted October 07, 2021

By Zach Scheidt

Pull Up Your Big Boy Pants, It's Earnings Season!

Shares of Levi Strauss & Co. (LEVI) are up 8.5% mid-day as I sit down to write this alert.

The company reported earnings last night. And investors loved what they heard from the iconic jeans retailer.

Quite frankly, LEVI's success was a major surprise…

Not just for the thousands of retail investors who are new to the investing game, but also for the Wall Street veterans who watch retail apparel companies like LEVI closely.

Today, I've got a few key takeaways from LEVI's report that will be helpful as we ramp up earnings season next week.

We're dealing with a volatile market, tons of uncertainty about the economy and the end of the year creeping up.

This earnings season, you'll need to be watching the action closely!

LEVI gives us a great case study for what to expect. So let's jump in and see what it took to drive this stock higher.

Wall Street's Low Hurdle for LEVI

Before we jump into LEVI's earnings report, you should understand that Wall Street's institutional investors were very pessimistic heading into this report.

They expected LEVI to report weak earnings thanks to supply chain shortages and higher costs to get merchandise into their stores.

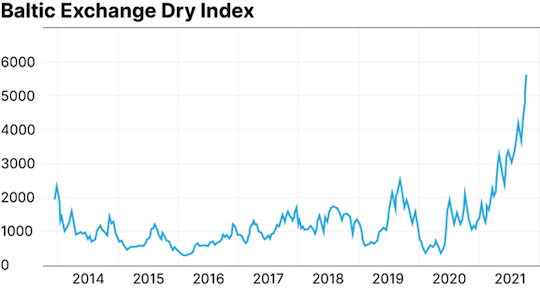

To understand just how bad things have become, take a look at the dry bulk shipping chart below.

This chart shows how the cost of transporting containers by ship has skyrocketed.

This is especially troubling for retail apparel companies like LEVI because much of their merchandise is manufactured overseas and needs to be shipped to the U.S. on these container ships.

But instead of reporting disappointing profits, LEVI hit the ball out of the park! Here are a few of the highlights from LEVI's earnings report:

- Adjusted earnings per share of $0.48 -- up from $0.08 last year

- Revenue of $1.5 billion -- up 41% over last year

- Increasing full-year profit guidance to $1.43-$1.45 per share (from $1.29-$1.33)

- Starting a new $200 million share buyback plan

What a surprise!

I listened to an interview with the company's CEO after the announcement and did some digging to find out exactly how LEVI is doing so well in such a challenging environment.

What I found was pretty impressive.

And it gave me a lot to think about as I look forward to earnings reports from many of the other companies we follow here at Rich Retirement Letter.

Balance, Diversification and Planning...

LEVI's successful quarter ties back to some very wise decisions the company made months ago that are now paying off for shareholders.

The company uses facilities in 24 different countries to manufacture its products.

So if there is a materials shortage, a labor issue, or some other challenge in any one of these locations, LEVI can simply get its inventory from another location.

LEVI has also already entered contracts to lock in its shipping rates through the summer of 2022.

So even though other retailers are paying higher costs to get inventory in time for the holidays, LEVI's costs will be stable.

This means the company:

- Will have product available to sell this holiday season

- And will not have to pay more to get it on shelves.

Think about how inflation will now affect the company's profits.

With retail prices moving higher (due to inflation) and LEVI's costs remaining stable (thanks to great planning), LEVI's profits will increase!

And that leaves the company extra profits which it can use to buy back shares of stock. (By the way, if you want to know how share buybacks work, I wrote up a quick explanation last night.)

Now, I'm not bringing LEVI's earnings report up to recommend the stock (although I do think LEVI is a great company and could have farther to run).

More importantly, I want us to keep a few of LEVI's lessons in mind for when earnings season ramps up next week…

LEVI's Lessons for Earnings Season

Here are a few important takeaways from LEVI:

#1: Pay attention to the sentiment ahead of the announcement.

Part of the reason LEVI traded sharply higher today was that Wall Street was so pessimistic before the announcement.

When investors already expect the worst, there's a lot of room for positive surprises. At the same time, when Wall Street is optimistic, be wary of the potential for negative surprises.

#2: Companies with deep pockets and experience handle challenges well.

LEVI was able to grow profits because the company had an experienced leadership team that planned for the worst well before things got challenging.

Also, the company had plenty of financial resources to be able to set up multiple manufacturing sites and to pay ahead for shipping costs before prices spiked.

In today's uncertain market, it pays to be invested in companies that have experience and capital on their side.

New companies with less cash and green management teams may do better when the market is in growth mode. But in challenging environments, I prefer to invest in stable, reliable situations.

#3: Be ready to act when opportunity knocks.

There's one more thing I forgot to mention about LEVI... the company just completed a buyout of a yoga apparel company. This will allow LEVI to expand into a new market and grow profits that are diversified from its classic denim jeans apparel.

LEVI was able to make this acquisition because the company had cash on its balance sheet and because someone was paying attention to market trends and which yoga apparel companies were for sale.

As we go through this earnings season, I'd suggest keeping a bit of cash in your brokerage account for a similar situation.

That way, if a stock on your watch list temporarily trades lower, you'll have some cash available to take advantage of the discount price.

That's all for today. I hope you're having a great week!

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King