Posted January 06, 2023

By Zach Scheidt

Sell the Sizzle, Buy the Steak

Greetings from Las Vegas, Nevada!

As this hits your inbox, I'll be walking through the Las Vegas Convention Center attending this year's Consumer Electronics Show (or CES).

I looked forward to this event to kick off each year before the pandemic.

It's amazing to have a first-hand view of all the new technology that will affect our daily lives over the next several years.

And while COVID kept the CES from happening on a full-scale level for the past two years, things finally seem to be getting back to normal.

If you follow me on Twitter, you'll get a first-hand view of the new technology that I'm researching here at the show.

Here's a quick series of pictures I took from the Amazon display room. (You can click on the picture to see them all).

I'm enamored with so much of the technology I'm seeing here at CES.

But as I take notes and talk to experts from many of Wall Street's top tech companies, I'm still keeping a relatively skeptical perspective.

Here's why…

Many Tech Stocks Are All Sizzle and No Steak

You've heard me talk about my boss and mentor Bill. When I was a young hedge fund manager, Bill helped keep me focused on the right things — the ones that made our clients money.

Bill is a down-to-earth guy, despite his tremendous success. And when he was training me, he had a knack for using colorful expressions to get his point across.

I distinctly remember him referring to a stock on my watchlist as "all sizzle, no steak." (A similar phrase he used for the talking heads on financial TV was "big hat, no cattle.")

With both of these phrases, Bill was warning me not to take things at face value and advising me to dig more deeply into the fundamentals.

Stocks that are "all sizzle, no steak" may look great at first. But if the companies behind the flashy technology don't make money, they're not likely to make great investments.

Similarly, if you take financial advice from someone who has no skin in the game, it's like following a cowboy with a big hat but no cattle.

Let's think about how this applies to Amazon, a company with great technology but questionable investment prospects.

Amazon may be a leader in technology and e-commerce, but the stock looks incredibly vulnerable to me.

Shares currently trade near $85, and the company is expected to earn just $1.65 per share in the year ahead.

That means investors are paying more than $50 for every dollar per share that Amazon will generate. That's a tremendously expensive price tag.

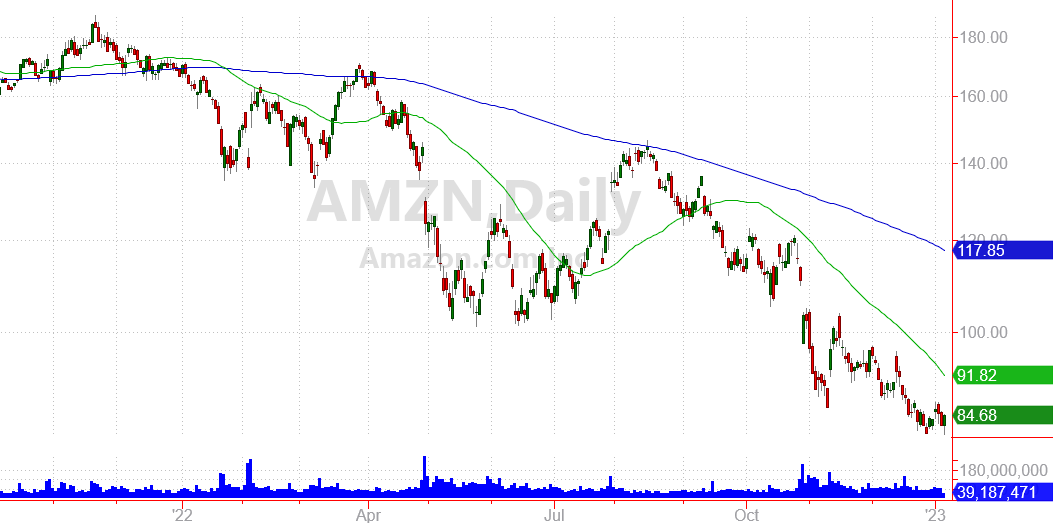

And remember, this is after the stock has already fallen sharply. Just take a look at the stock’s recent price action in the chart below.

In Bear Markets, Focus on Substance

There is certainly a time and a place for investing in high-growth speculative tech stocks.

These stocks made many investors rich during some of the market's strongest seasons, especially when interest rates were low and these unprofitable companies had access to virtually free money.

But in today's market, we need to be investing in stocks that have both the sizzle and the steak!

This doesn't mean we can't invest in exciting technology. But it does mean we need to be selective about which tech stocks we put our hard-earned money into.

And sometimes, the best technology shows up in unexpected places. Take a look at this tweet I sent out yesterday.

You might not think of the tractor company John Deere as a tech powerhouse. But it’s at the cutting edge of designing autonomous equipment that makes a huge difference for customers.

I've visited John Deere's display at CES for years, and I've always been amazed by the satellite imagery, precision planting and fertilizing, and the tremendous efficiency the company offers to farmers around the world.

And this is a stock with substance, generating reliable profits, trending higher year after year, and paying a healthy dividend.

Plus, if you buy shares today, you're paying a little over 15 times next year's profits — much better than the $50 per dollar of profit you pay for Amazon.

In a bear market, there are still plenty of opportunities to invest in tech. But you have to be able to see beyond the sizzle to find truly worthwhile investments.

I'll keep looking for the best stocks to recommend to you here at Rich Retirement Letter. For now, I'm headed back to the show to see what other profitable opportunities I can find.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King