Posted March 20, 2023

By Zach Scheidt

The Case for $3,000 Gold

As we kick off another high-stakes week, I've got my eye on an area of the market that’s ticking higher…

And given what I see on the horizon, this could be just the start of a much bigger surge!

This week will certainly be full of twists and turns as we navigate the banking crisis. Over the weekend, Credit Suisse was bought out (or more accurately rescued) by rival UBS Group.

The merger is eerily similar to how Bear Stearns was taken over by J.P.Morgan, or how Merrill Lynch was merged with Bank of America during the financial crisis of 2007-2008.

Meanwhile, the Fed is scheduled to release its interest rate decision on Wednesday.

Until recently, it felt practically guaranteed that the Fed would hike rates this month. But now the decision is much less certain.

As you may have noticed, the stock market has been swinging wildly back and forth with every new headline.

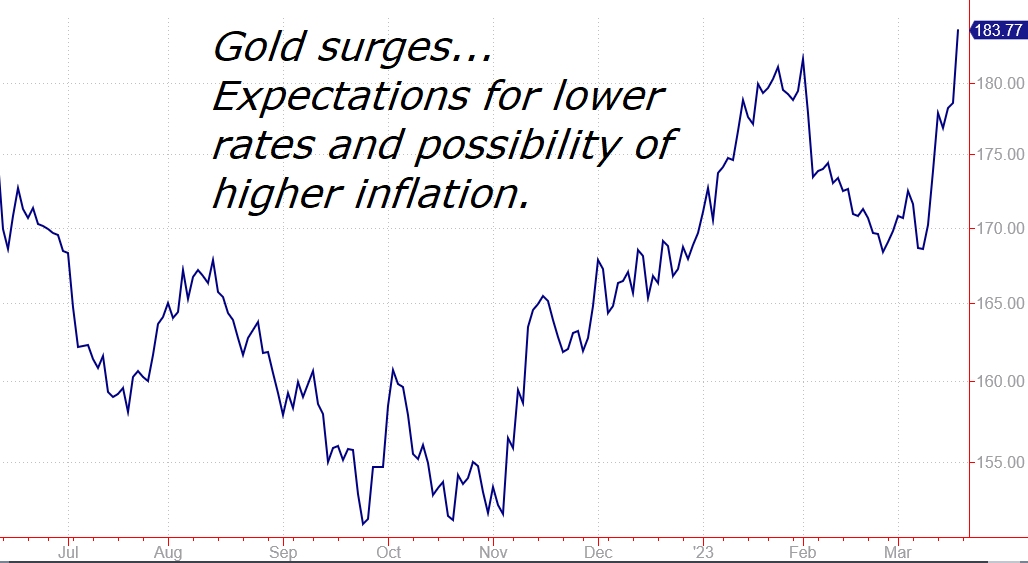

But the price of gold has been moving in just one direction... up!

Today I want to explain why we could see gold hit $3,000 per ounce. And I'll share one of the most aggressive ways you can profit from the next move higher.

Low Interest Rates = High Gold Prices

It's hard to know exactly what the Fed will do this week. If Powell raises rates, he risks pushing a fragile economy into a recession, especially in what has become a vulnerable banking system.

But if the Fed keeps interest rates steady or cuts rates, we risk inflation rearing its ugly head. Given the billions promised to banks, extra liquidity in the system could make the situation even more dangerous.

Regardless of what the Fed does this week, investors expect the Fed will be forced to cut rates — possibly several times — by the end of the year.

Gold is surging based on these new expectations. Essentially, lower rates could trigger a perfect environment for gold to trade up to $3,000 (or even higher).

Low interest rates tend to pressure the value of the U.S. dollar. Basically, when international investors get less of a return on dollars, they're more likely to pull their money and invest it elsewhere.

Capital moving out of the dollar will naturally act as a tailwind for gold.

Meanwhile, if inflation comes back like when the Fed stopped hiking rates in the 1970s, investors would scramble to protect the value of their wealth. And gold is the best way to do this!

Bottom line: I expect gold to continue its sharp rise this year. So I want to make sure you're in position to profit!

Owning Gold Versus Trading Gold

If you've been with us at Rich Retirement Letter for some time, you know that I always recommend owning some gold to keep your investments balanced.

Gold can be a great long-term investment to help protect the value of your savings over time.

But I also recommend trading gold (or buying gold for a shorter period of time) during certain economic seasons. And this happens to be one of those seasons!

As the banking crisis began just over a week ago, I told you that precious metals could surge. That's exactly what has happened!

Gold should continue to rally throughout the year, but it will almost certainly be a bumpy ride with plenty of ups and downs.

That's because as new information comes out, traders will continue to adjust their positions to try to get ahead of the changes in our economy. So don't expect a straight line higher.

You’ll want to add to your gold position on any pullback. And you might also consider taking some profits off the table when we get a surge like the one we had last week.

For my family's money, I've been buying in-the-money call option contracts on the SPDR Gold Trust (GLD). I like this approach because call option contracts let me book larger profits while committing less capital.

And when GLD trades higher, I can sell the call contracts I have for a profit and use a portion of that profit to buy new contracts with a higher strike price.

This is a great way to lock in profits while still keeping my position in play. If you want to know more about this aggressive strategy, stay tuned!

I’m working on a project behind the scenes with my team. Once we’re done putting on the finishing touches, I’ll have some exciting news to share with you.

For now, make sure you have some of your retirement savings invested in gold. And be sure to follow me on Twitter for day-to-day insights on today's market.

After all, things are changing quickly and it's great to have this line of communication for me to share charts, investment plays, and trade ideas with you.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King