Posted June 02, 2023

By Zach Scheidt

The Greatest Heavyweight’s Approach to Trading Today’s Market

As I'm sure you've noticed, we’re not exactly in a normal market environment.

We had the debt ceiling crisis looming over our heads for weeks...

It appears that a recession could be just around the corner...

Inflation is still out of control, pressuring family budgets around the world...

Geopolitical risks from Russia, China and the Middle East are very concerning...

And while the stock market is technically up on the year, only a handful of stocks are driving it higher, leaving most others behind.

In short, this is one of the more difficult market environments I can remember.

But despite the challenges, there are still some incredible opportunities. And I’m very excited about these opportunities and your potential profits for the rest of the year.

Last week, I was thinking about the broad market and came up with an analogy...

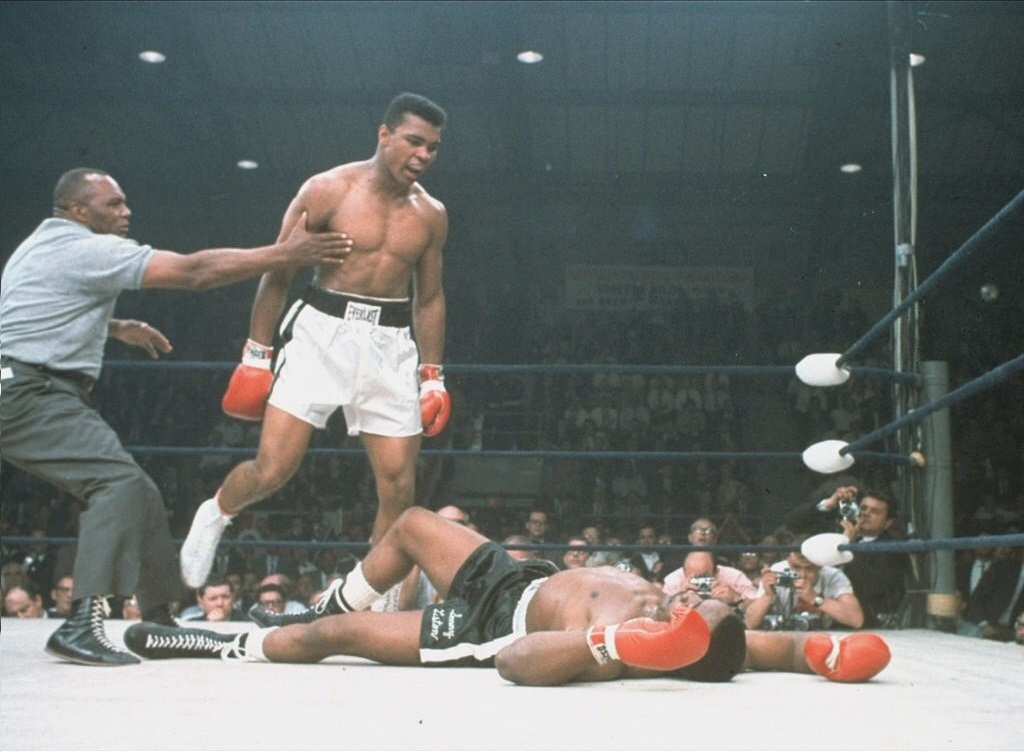

To have success in this environment, you need to approach this market a lot like Mohammad Ali, one of the greatest heavyweight boxers of all time, approached his matches.

It may sound corny, but stick with me for a moment...

"Float Like a Butterfly..."

I'm sure you remember Ali's famous phrase "Float like a butterfly, sting like a bee."

If you watch replays of his most famous fights, you'll see Ali dancing around the ring, dodging punches over and over.

This bob-and-weave technique kept Ali out of harm's way while his opponent slowly ran out of energy.

Meanwhile, Ali was studying his opponents every move, making mental notes of his rival's strengths and weaknesses.

Sometimes Ali would get cornered with his back against the ropes.

(If you've been investing in the stock market a long time, you know there are seasons like this. Everyone has their back to the wall at some point.)

But Ali didn't let this position discourage him. Instead, he would play defense, keeping his guard up.

His opponent would burn through precious energy swinging away, while Ali absorbed the punches with very little damage.

During the first few months of this year, I feel like we've been taking a page from Mohammad Ali's book.

We've been in the ring duking it out and looking for areas of profit. And while we've had some wins, there haven't been too many chances to land a knockout punch.

As a professional trader who's been at this game for more than two decades, I'll tell you this kind of bobbing and weaving is ok!

It's perfectly natural to have a season when the market doesn’t give us too many home runs, or seasons when we take a few hits while waiting for our chance to strike.

The key during times like this is protecting your capital, having patience, and keeping your head up. Because our opportunities for success will come in time.

"Sting Like a Bee..."

Mohammad Ali’s best moments often happened in the later rounds of his fights.

After studying his opponent's weaknesses and patiently waiting for his chance, Ali was finally ready to strike.

And when he did, the punches he landed were incredibly powerful!

This was partly because he trained and kept his fitness levels high. But mostly it was because he was patient and waited for the exact moment to take the perfect shot.

We're getting close to a season in the stock market that’s ripe for landing punches. And that's true both for bullish and bearish opportunities I'm tracking.

The recent surge from Nvidia could be a blowoff top for speculative stocks, marking the end of the bull market for these stocks and the beginning of a new bull market for other fundamentally sound stocks.

I've been watching stocks like NVDA closely and getting ready to take some swings at them once the tide turns.

And I've also got some cash on the sidelines ready to invest in big opportunities I'm seeing for energy stocks, defense contractors, precious metals and a few other important sectors.

You may have already joined my Income Alliance trading service, which I launched to help you take advantage of the timely opportunities this market is giving us.

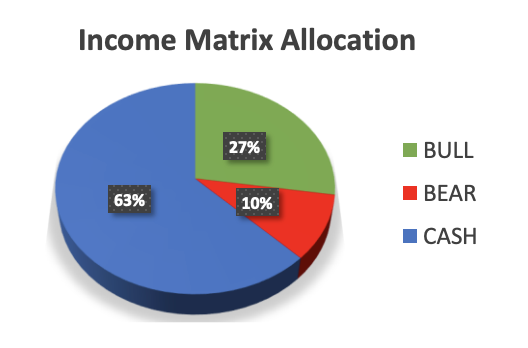

If you haven't heard, I put $100k of my own capital into a trading account. And I'm letting Income Alliance members follow along as I put this money to work.

Take a look at the pie chart below that shows how much cash I've put to work already and how much dry powder I have ready to go...

As you can see, I've already put some of my cash to work.

But up to this point, I've been holding back and waiting for the perfect opportunity to start landing knockout punches.

I can't wait for the market to let its guard down so we can start pounding out profits. And I hope YOU will join me as we "float like a butterfly" and "sting like a bee" this year.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King