Posted January 03, 2022

By Zach Scheidt

The Single Most Important Theme for 2022

Your retirement account faces a critical juncture as we kick off a brand-new year,…

Over the past few quarters, the stock market recovered sharply from the coronavirus mini-crash.

This recovery period created some quick and easy profits for investors. And hopefully, you were able to capture many of those profit opportunities in your retirement account.

But as we turn the page on the calendar and start a new year, that recovery period is shifting.

In many ways, the reaction to the crisis and the government stimulus that followed is over.

Now the markets are settling into a "new normal." And as the economy settles into a more predictable pattern, our investment opportunities are shifting.

So this week, I wanted to take a look at the most important trends that you need to watch in this brand new year.

Some of these trends will create tremendous opportunities… and others carry risks that you'll need to protect yourself from.

Today, we'll start with one of the biggest trends of the year. It’s a situation that carries both risk and opportunity.

And to be on the right side of this trend, you'll need to be very proactive.

The #1 One Trend for 2022: Inflation

Here at Rich Retirement Letter, we've been talking about inflation risks for quite some time. After all, prices have been rising for several quarters at this point.

But just because you're up to speed on this risk, that doesn't mean that the rest of the world understands what's going on.

It's taken a long time for the idea of inflation to sink in. Over the last 10 years, inflation has been eerily absent and the Fed has even been concerned that we didn't have enough inflation.

But now, inflation is clearly picking up. And Fed Chairman Jerome Powell is finally acknowledging that inflation is here to stay.

This new season of inflation is the result of many different factors all working together:

- Government stimulus giving consumers more money.

- A tight labor market (companies have to pay more to entice workers).

- Supply chain bottlenecks and difficulties shipping things.

- Strong financial and real estate markets (again, giving consumers more money).

The list of inflation factors is actually much longer than that. But those are the biggest concerns.

Inflation Is Widespread — Not Just Goods

Unfortunately, the financial media outlets (and even professional investors and the Federal Reserve) still don't seem to understand the whole picture.

They continue to tell us that inflation is largely contained to goods, or the tangible things that you buy. Prices for the services you buy aren't supposed to be rising.

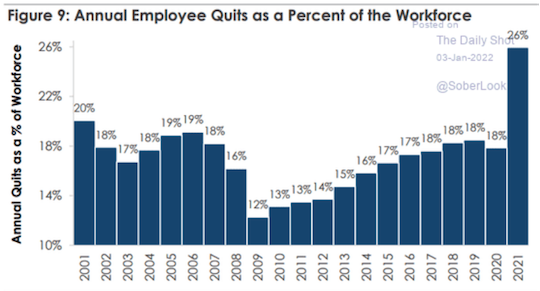

But this chart pokes a big hole in that argument.

Source: The Daily Shot

The graph above shows the percentage of workers who have voluntarily quit their jobs over the last year. You can see that 2021 had a dramatic surge in the number of workers quitting.

Why does this matter to us?

Because when workers quit, companies have to compete for labor.

That means offering higher wages, more expensive benefits and perks like shorter workdays and more days off (which in turn means hiring more workers to fill those needed hours).

This trend is spread across the entire economy. And companies that sell services instead of goods must pay higher prices to convince workers to show up.

Of course, with higher labor costs, these service companies have to jack up their prices if they want to remain profitable. And this trend is just starting to work its way through the entire global economy.

The bottom line?

Inflation — across both goods and services — is here to stay. And if you want your retirement account to keep up, you're going to need to be very intentional with how you invest.

Inflation-Buster Investments for 2022

If you want to beat inflation and protect the purchasing power of your retirement account, there are a few key areas you need to be invested in.

First, it's important to invest in stocks tied to tangible goods. This is the first side of the inflation equation that everyone is finally acknowledging.

We've talked about many of these investments including equipment companies, stocks of companies that mine raw materials and infrastructure plays.

A second area to focus on is productivity and automation technology.

After all, when companies find it difficult and expensive to hire new workers, the next step is to replace those workers with technology.

Now, a word of caution here... We want to focus on the tech stocks that are already generating reliable profits.

Intuit Inc. (INTU) is a good example of this kind of tech company. Intuit helps small businesses with accounting and tax preparation. Software from Intuit can actually help small businesses hire fewer people and still get more done.

Finally, I shouldn't talk about inflation without mentioning cryptocurrencies.

Since this is such a new area of the market, there's a lot of uncertainty and misinformation floating around. I'm thankful to have a colleague like James Altucher on our team to help single out the best crypto plays in today's dynamic market.

While I believe cryptocurrencies should only be a part of an overall balanced investment portfolio, there's no denying that cryptocurrencies have been an effective hedge against inflation over the last few months.

Tomorrow, we'll cover a second major trend that I'm watching... One that affects your retirement perhaps more than any other trend in today's market.

Just like inflation, this trend carries both risk and opportunity.

So make sure you tune in so you can be on the right side of this important (and often misunderstood) theme.

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King