Posted June 07, 2022

By Zach Scheidt

The Warning I Gave to My Daughters This Week

This weekend, I pulled my three oldest daughters aside for a serious conversation.

Now that school is out for the summer, each of them is doing a lot more driving.

Sometimes to work, other times to visit friends, or occasionally to take their younger siblings to various activities.

"Girls, I need you to each promise me something…"

They knew I was serious at this point.

"Please get more gas any time your tank is half empty. I don't want you to get stranded somewhere."

I don't think I've ever been this worried about my girls out on the road. And I'm worried about our Rich Retirement Letter community too!

Because energy shortages may soon be causing some much bigger problems for our overall economy.

Poor Planning Leads to a Dangerous Situation

Several years ago, I was at a conference on the West Coast when I got an unexpected phone call from my wife back in Georgia.

It seemed she forgot to fill up her gas tank and was stranded on the side of the road.

To make matters even worse, it was a hot and humid summer day in Georgia. And she had our two youngest children in the car with her.

Not a good situation, and there was no way I could get to her in time to help.

Fortunately, we were able to get in touch with roadside assistance, and they got to her location relatively quickly.

But for a few minutes, I was incredibly worried about their safety.

I bring this story up today because our entire country now finds itself in a similar position. And I'm not sure there's a good "roadside assistance" program to help make things right.

You see, for years our country has underinvested in developing new sources of energy. And with fewer oil and natural gas wells available, we're now in a precarious situation.

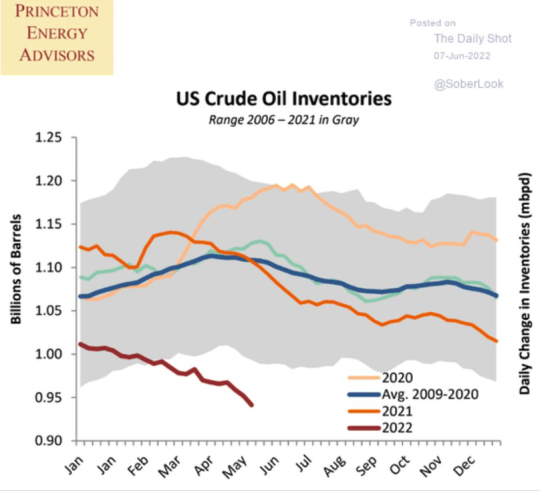

We simply don't have enough oil to meet our energy needs! Take a look at the chart I posted on my Twitter feed this afternoon.

(By the way, if you want to see my day-to-day thoughts on market trends, stock ideas, and even the occasional family picture, follow me on Twitter!)

Low oil reserves could trigger several major risks in our economy — risks that you need to be prepared for ahead of time.

Shortages Lead to Higher Costs

Low oil inventories don't just cause gasoline prices to rise. And the problem is already bleeding over into other areas of the economy.

Transportation costs are just the start...

When you buy something at your local grocery store or Amazon, you're not just paying for the item.

You're also paying for the cost of shipping that item to the store or to your door. And with oil and gasoline inventories extremely low, those costs will continue to rise.

So despite some of the encouraging data points we've seen in the last couple of weeks, our economy is not out of the inflation woods.

And that means you need to be prepared to pay more for everything you buy.

That's the bad news.

But the good news is that you can also earn more by investing in shares of companies that benefit from inflation.

Here at Rich Retirement Letter, we've been highlighting resource companies like:

- Rio Tinto (RIO), one of the world's largest copper makers...

- Vulcan Materials (VMC), a miner that serves the infrastructure and construction markets.

- Energy plays like Devon Energy (DVN)

- And pipeline companies like Kinder Morgan Inc. (KMI).

These companies can help you grow your wealth at a time when inflation would normally eat away at your savings.

So investing in plays like this is a proactive way to fight against shortages and inflation — kind of like filling your tank up before you run out of gas!

I'm hoping for the best with our economic recovery.

But at the same time, I want to make sure you're taking steps to protect your wealth and your family's wellbeing in this turbulent environment.

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King