Posted December 11, 2023

By Zach Scheidt

This Breakout Will Wake a Sleeping Giant

Today I’ve got an income opportunity for you that’s been years in the making.

You may already know that I've had my sights set on gold hitting $3,000 an ounce for a while now.

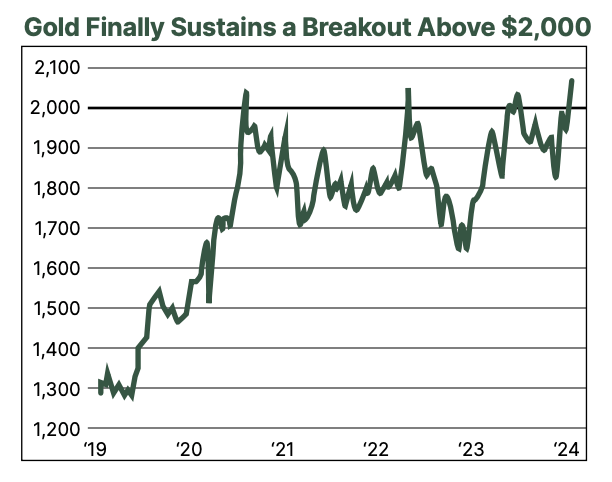

After stubbornly choppy trading, gold has finally cleared a major roadblock that sets the stage for this epic surge.

In November, gold closed above the key $2,000 resistance level for the first time ever.

With inflation still in full force and the dollar reversing, fundamentals are finally aligning for gold to soar to my long-held price target.

And this imminent gold rally creates an incredible investment opportunity for the year ahead.

A Gold Breakout Years in the Making

Long-time readers will know that I’ve been bullish on gold for a while. Specifically, I’ve had my eye on a price target of $3,000 an ounce since 2021.

After all, the past few years have been a textbook case of an environment where you’d expect gold prices to soar.

Inflation has risen at a record-high clip, two major wars have broken out, and the stock market has been volatile as investors maneuver the uncertainty.

However, gold’s price has been stubborn. In 2020, gold rallied above $2,000 an ounce for the first time before quickly retreating.

This briefly happened again in 2022. But gold still failed to make a sustained push above that resistance level… until now.

In November, gold closed the month above $2,000 an ounce for the first time ever.

Naturally, gold surpassing this psychologically important milestone will attract attention from mainstream investors and financial media.

And speaking from a more technical level, this breakthrough finally clears the way for gold to soar to $3,000 an ounce in 2024.

With gold surpassing this major milestone, you’d expect that investors would be buying shares of the major gold miners hand over fist.

However, these stocks have yet to join in on the breakout. I don’t expect these sleeping giants to stay dormant for much longer though.

Once mainstream investors see the writing on the wall, the major miners will emerge as the clear winners of this historic moment for gold.

But before I get too ahead of myself, let’s review the momentum that will quickly drive gold to hit its next big milestone.

Gold’s Next Milestone: The Case for $3,000

This time last year in my annual investment outlook, I predicted that gold would finally hit $3,000 an ounce in 2023. Needless to say, this didn’t turn out as I predicted.

But I do expect that we could see gold finally hit my price target in 2024. Here are a few of the fundamentals working in gold’s favor right now…

While down from its peak, inflation is still elevated compared to the pre-pandemic levels. And the factors that drove prices up in the first place haven’t exactly been resolved either.

We also know that when inflation rises as quickly as it has recently, it often takes several years before prices begin to stabilize.

Gold is typically a great hedge against inflation. Even if gold doesn’t outpace inflation, it should at least rise at a similar rate.

The precious metal certainly hasn’t kept up with inflation over the past three years, however, which means it has a lot of catching up to do.

One reason gold hasn’t kept up with inflation is because it’s had to compete with a strong U.S. dollar. And when the dollar is strong, it has more purchasing power.

In other words, it takes fewer dollars to purchase things like a car, food, or gold. This can keep prices of commodities fairly tame, even in an inflationary environment.

But the dollar is starting to trade lower. Combined with inflation, these two factors will act as a tailwind for the price of gold.

And finally, the move above $2,000 an ounce in November gives me confidence that gold is cleared for takeoff after years of choppy trading.

As I mentioned earlier, gold has encountered this resistance before. This indicates that sellers are unloading their gold positions when prices rise to that level.

You may hear investors talking about a “triple top” pattern, essentially meaning gold will retreat once again. But I don’t believe that’s the case.

At some point, the resistance has to break once sellers are done unloading their position. With the residual sellers washed out, it’ll be blue skies ahead for gold.

I’ve seen price targets predicting gold will hit $2,200… $2,600… or even $4,000 an ounce within the next year. But $3,000 represents the next psychologically important milestone.

After so much time trading below and right up to the resistance level, this should prove to be a watershed moment for gold.

As I mentioned earlier, major gold miners like Barrick Gold (GOLD) and Newmont Mining (NEM) haven’t yet participated in the rally.

Once these sleeping giants awaken, however, they’ll emerge as the clear winners of this historic moment for gold.

So I recommend getting exposure to the major gold miners now while their shares are still trading at depressed levels.

It could be one of the best chances to grow your income over the next year!

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King