Posted November 21, 2022

By Zach Scheidt

This Chart Says It's Time to Buy

When I started my career at a boutique hedge fund, I had a standing Monday appointment with my boss Bill.

At the start of each week, Bill would pull out a series of black notebooks with dozens of charts he kept by hand.

He’d spread the charts out across his office floor and we’d walk around the room looking at the different indicators and price points that Bill had logged during the weekend.

It took me a few weeks to catch on. But Bill was teaching me to connect the dots from different areas of the market.

Eventually, this process helped me understand how different areas of the market affect certain stocks.

And these associations can help you make some big profits once you see how the puzzle pieces fit together.

Today I want to show you how a shift in one chart can lead to retirement income for you.

The Dollar's Shift Is an Investment Catalyst

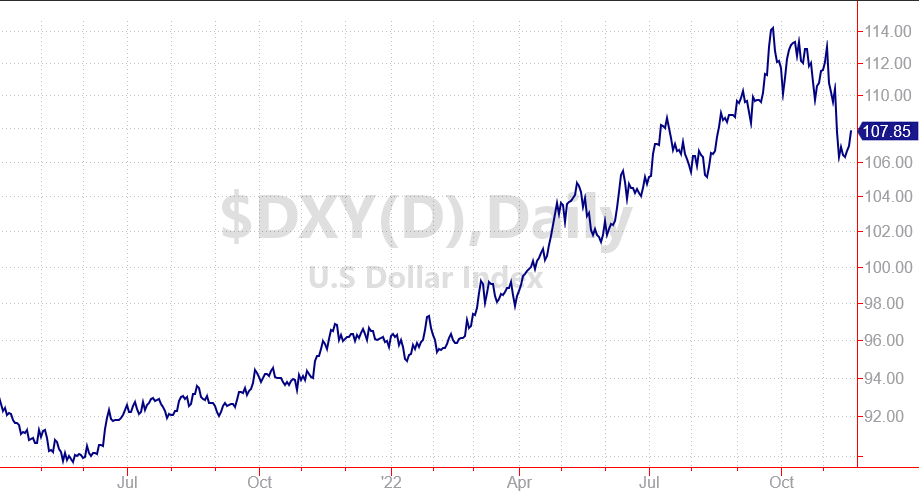

Take a look at the chart below. It's a picture of the U.S. dollar compared to a basket of other international currencies.

As you can see, the dollar has been trending higher for much of the year.

That's largely because the Fed has been hiking interest rates, which means foreign investors can get better yields for dollar-denominated investments.

And while this trend has been in place for several quarters, we're now seeing a major shift.

Instead of continuing higher, the U.S. dollar has rolled over. In other words, the dollar is weakening compared to other currencies like the euro, the British pound or the Japanese yen.

If you're not a currency trader, you may not be too worried about trends for the U.S. dollar.

But these trends have a major effect on American businesses. And the dollar's shift lower opens some great opportunities for investors who understand currency dynamics.

A Tailwind for Blue-Chip International Plays

A weak U.S. dollar is great news for American companies with customers around the world.

For starters, a stronger euro, British pound or Japanese yen makes it easier for international customers to afford the goods or services that American companies offer.

Think about it this way...

A 1 million dollar monthly service contract would have cost a customer 1 million euros when the dollar and euro were trading at parity.

But that same contract for 1 million U.S. dollars would only cost about 833,000 euros if the dollar weakens to where it stood at the beginning of 2021. (At the time, it took $1.20 to buy a single euro).

So American goods and services are more affordable when the dollar weakens, making U.S. companies more competitive in international markets.

A second benefit is the way profits are reported here in America.

If the euro is trading at parity with the U.S. dollar, a 1 million euro profit would naturally equal a million dollars in profit for the U.S. company.

But when the dollar weakens, 1 million euros in profits might actually translate to $1.2 million in U.S. currency.

So American companies can earn more with the same amount of business just because the dollar is weakening.

International Stocks Worth Watching

As the U.S. dollar weakens, I've got my eye on a couple of important U.S. stocks that will benefit.

Procter & Gamble (PG) is a well-known company that sells consumer staples products around the world.

Customers will purchase these products in good times and bad. Because even in a recession, you still need to brush your teeth, wash your clothes and keep your house clean.

So PG's underlying business will remain stable. And the weakening U.S. dollar will naturally drive profits (in U.S. dollars) higher.

PG pays a 2.6% dividend yield, which makes the stock a great income play for your retirement account.

Similarly, Coca-Cola (KO) is an American company with customers around the world.

The weakening dollar makes KO's products more affordable for restaurants, event venues and individual consumers.

Meanwhile, sales in Europe, Asia and everywhere else in the world translate to bigger profits for KO when the dollar weakens.

KO is another great dividend stock, paying you a 2.9% yield. Plus as profits grow, I expect both of these companies to increase their dividend payouts over time.

A weakening U.S. dollar might sound like a negative event. But there are several great investments that will pay off as the dollar trades lower.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King