Posted September 04, 2023

By Zach Scheidt

This may be controversial, but…

It's time to buy a retirement investment that will:

Pay plenty of income and grow in value over the next few years.

Now, the opinion I'm about to share with you may be a bit controversial. And I'll also admit that it might be a bit early.

But if you invest in the opportunity we'll be covering today, I'm very confident you'll be in great shape to build your retirement wealth over time.

The Unique Opportunity for Treasury Bonds

The surge in interest rates, specifically long-term interest rates, has been the big news this week for a few reasons...

- The economy is holding up with less risk of recession.

- Inflation continues to be a significant concern.

- The Fed minutes showed that some members continue to be hawkish.

- The U.S. Treasury must sell bonds (including long-term bonds) to fund America's debt.

All of these factors are driving interest rates higher, which in turn sends the price of long-term Treasury bonds lower.

Just take a look at the action for the iShares 20+ Year Treasury Fund (TLT), which tracks the prices of long-term Treasury bonds.

Let's quickly look at why bond prices have fallen so much.

How Bond Prices Work

When you buy a Treasury bond, you're buying a guarantee backed by the full credit of the United States, which pays you as an investor based on a predetermined schedule.

For instance, a 20-year Treasury bond with a 2% coupon would send you a 1% (or $10) payment twice a year and give you back $1,000 at the end of the 20 years.

This schedule is fixed, which is why bonds and similar investments are considered fixed-income assets.

No matter what happens to interest rates, the existing bond will still pay 2% every year and still mature at $1,000.

If long-term interest rates are near 2%, you'll probably be able to buy the bond somewhere close to $1,000.

That's a fair price because you'll receive 2% payments for 20 years. And you'll get your $1,000 back when the bond matures in 20 years. In other words, pretty standard.

But what happens when long-term interest rates increase, say to 5%? How do existing long-term bonds perform then?

Well, since bonds don't change their payment schedule, the only thing that can change is the market price for the bond.

In this case, the bond price would have to drop substantially.

That way, a new buyer would get the $10 payment twice a year, the $1,000 payment when the bond matures, and a total annualized return of 5%.

For long-term bonds, the price can decline substantially to adjust for a much higher long-term yield. And therein lies the opportunity.

Buying Treasuries at a Discount: More Yield and Great Returns

Now that long-term interest rates have moved sharply higher, investors like you and me can get great discounts buying long-term Treasury bonds.

Most brokerage platforms allow you to buy individual Treasury bonds at current market prices.

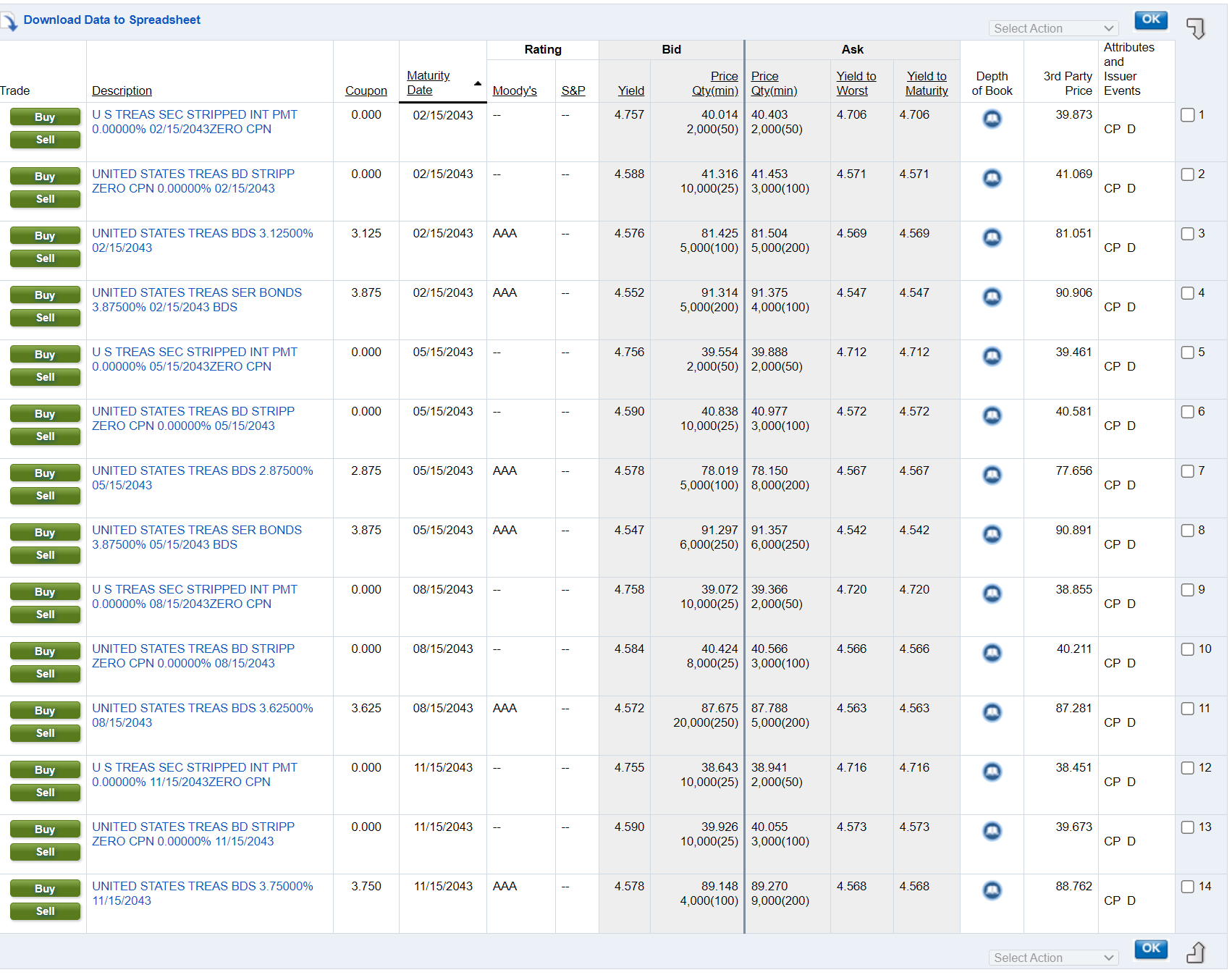

Just for fun, I looked up all of the available Treasury bonds maturing in 2043 to get an idea of what long-term bonds you can buy today.

At the far right, you can see current prices for these bonds, ranging from $0.39 on the dollar for zero-coupon bonds to $0.91 on the dollar for bonds that pay $3.875 each year.

High interest rates have pushed the prices lower for these bonds. But if interest rates pull back in the next few years, these long-term bonds will rebound quickly.

Meanwhile, the bonds are still contractually obligated to pay you the fixed income along the way and give you $1,000 when the bonds mature.

Short-Term versus Long-Term Picture

In the short term, the trend for bond prices is lower. And I don't know how long that will last.

At this point, we're likely getting close to the end of rate hikes. And sometime in the next two years, we're likely to see rates cut, especially if the broad U.S. economy weakens.

Keep in mind, the U.S. can't afford to keep piling on debt as interest rates rise. So at some point (and relatively soon), there will be political pressure to drive interest rates lower.

My recommendation for a long-term retirement play is to start accumulating some long-term Treasury bonds.

I prefer the actual bonds compared to a fund, that way you'll know exactly what your coupon payments will be and when your bonds will mature, paying you $1,000 per bond.

With interest rates now above the rate of inflation, you're getting a great deal on the investment.

And the potential for lower interest rates means that your bond could quickly surge higher once rates start falling.

This would give you a chance to sell early at a higher price and reinvest the money into other opportunities that the market gives us.

Three years ago, I was pounding the table on how you should sell Treasury bonds and steer clear of this area of the market.

But now it's time to start buying these wealth-building tools as long-term (and possibly very lucrative) retirement investments.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King