Posted September 20, 2021

By Zach Scheidt

Time Out!! Market "Bench Players" Have Been Waiting for This

I'm calling a quick time out for our retirement investments.

If you're worried about this market selloff, you might be logged on to your brokerage account with your finger over the sell button.

But please take just a few minutes to pause...

This time out is exactly the same kind of breather you might take if you were coaching a basketball or football game.

Maybe your players are getting a little winded and they need a quick break. Or maybe it's time to pull some of the fresh substitute players off your bench and get them in the game.

In fact, that's exactly what's happening in the market right now. And it's a very healthy thing for your retirement investments.

So before you make any big changes to your retirement investments, let's take a quick look at what's actually going on behind the scenes.

"If Only We Could Get a Quick 15% Correction"

Just over a week ago, I had a chat with my friend Paul who is a financial advisor.

"Zach, I just wish we could get a good old-fashioned 15% correction."

That's not exactly what I expected to hear from someone who makes a living helping people with their investments.

After all, a pullback in the market would likely cause some of his accounts to lose value — which could reduce the fees that his firm charges.

But Paul went on to explain. And his logic made a lot of sense!

"I've got several clients who are just itching to add to their stock positions. But they're worried about buying too close to the top.

"If a few of their favorite stocks pulled back just a bit, they would put more money to work. That would help them grow their wealth and help my company grow!"

It's a perspective that I've heard from many different investors that I talk to.

And quite frankly, I've seen this movie before!

There have been many times during my investment career that we've seen markets move steadily higher with investors standing on the sidelines watching.

During those periods, it only takes a few days of selling before all of that sideline money comes running onto the field — just like a fresh set of substitute players ready to help their team!

The Probability of a Selloff Is Low

As investors, we're always dealing with a certain level of uncertainty.

The truth is, I can't tell you exactly where this market is going and neither can anyone else.

But there are tools that can help us understand what is most likely to happen. And by using these tools to better understand how markets are situated, we can stack the odds in our favor.

Do this through enough market cycles and you'll be much more successful than your friends and neighbors who are swayed by emotions.

Sentiment indicators are some of the best tools to help us understand risks in the market.

These tools basically tell us what most investors are feeling about the market — which gives us a great idea of how these investors are likely to act.

Ironically, sentiment measures are typically contrarian indicators. So when sentiment is bullish, the market is typically more vulnerable to trade lower. And the opposite is true when sentiment is bearish.

Over the past week, individual investors turned quite bearish. Concerns about inflation, the debt ceiling, higher interest rates and geopolitical issues have led to investor uneasiness.

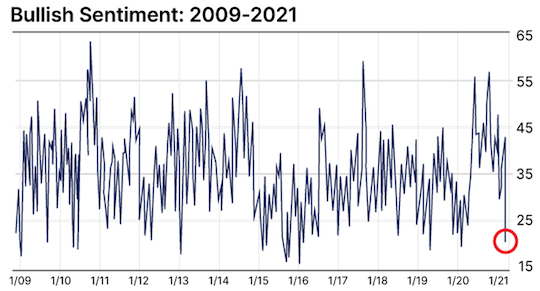

The chart above shows the percent of individual investors who consider themselves bullish on the market.

The current reading of 22.4% is one of the lowest readings on record — especially in the last several quarters.

Statistically, when the number of bullish investors drops, it means the market is unlikely to drop. In fact, low sentiment readings typically happen just before a big surge higher in the market.

This might sound counterintuitive but it actually makes sense.

The Irony of Weak Sentiment/Strong Markets

When investors are feeling less confident, they've typically already made changes to their investment account.

So these fickle investors have largely pulled out of the positions they're afraid of and the damage has already been done to the market.

Meanwhile, these investors now have cash on the sidelines, along with the cash that my friend Paul manages. (Paul has thousands of colleagues in the same situation with cash ready to go to work.)

Now that the market is starting to pull back, Paul can start calling his clients and helping them invest their sideline cash positions.

These buy orders will help to put a floor under stock prices. In other words, it's unlikely that the market will fall much further with sentiment already negative and with so much cash ready to be invested.

If we saw the same type of selloff in the market and investors were bullish (with most of their cash already committed to the stock market), I might encourage you to be more defensive.

But the current selloff looks much more like a healthy pullback within the context of an overall bull market.

So instead of panicking, I encourage you to look carefully at your favorite stocks and consider adding to your positions on this pullback.

After all, fresh legs are coming in to help drive this offense forward!

Here's to living a Rich Retirement,

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King