Posted September 12, 2022

By Zach Scheidt

To Beat Inflation, Stock Up on Income Plays!

Tomorrow's Consumer Price Index (CPI) report will be a major catalyst for the stock market.

If the report shows inflation is light, investors will expect the Fed to slow down its aggressive interest rate hikes. And that excitement should cause stocks to surge.

But if inflation continues to be strong, expect another pullback (if not an absolute rout) for the major averages. That's because investors will panic expecting the Fed to go nuclear with interest rate hikes.

If the Fed keeps raising rates aggressively, it will send the U.S. economy into a deep recession. And that possibility has investors on high alert.

So if this CPI report is so important — and could lead to two very different outcomes — what should you do?

Today, we'll open the playbook and decide the best path to grow and protect your wealth.

Income Trumps Inflation

For months now, we've discussed how growing your income can help you beat inflation.

One of the easiest ways to grow your income is through dividend stocks, especially stocks that continually increase their payouts to investors.

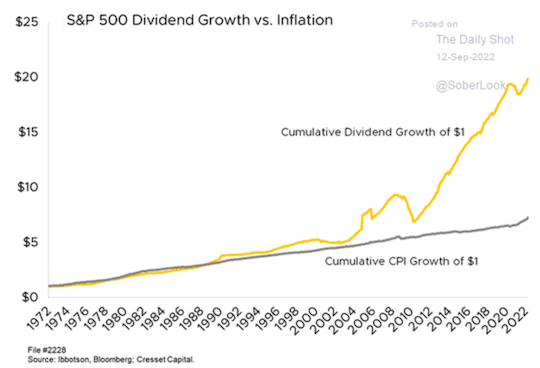

Need proof? Look at the chart below which used data compiled by Ibbotson, Bloomer and Cresset Capital.

Over the last 50 years, income from an investment in the S&P 500 index has far exceeded the growth of inflation over the same period.

Keep in mind that income growth comes from the entire S&P 500 index, which includes stocks that pay dividends and many others that don’t.

Imagine how much more income you would have if you focused exclusively on the companies that send payments to their investors!

This is an important concept for today's market when your highest priority should be protecting the value of your savings.

Dividend stocks do an excellent job of protecting that wealth. These stocks send you real cash payments (every single quarter in most cases).

And they also hold their value better than non-dividend paying stocks. That means even if the market pulls back, your investments are more likely to protect the wealth you've worked so hard to save.

So let's take a quick look at some of the best blue-chip dividend stocks you can hold in today's market.

3 Dividend Stocks to Own Today

One of my all-time favorite dividend stocks is Blackstone Inc. (BX). It’s a private equity firm, which means Blackstone invests capital for some of the wealthiest individuals, endowments and pension plans.

Blackstone uses a lucrative business model that charges management fees to bring in reliable profits and incentive allocations, which can be much more profitable.

These incentive allocations allow Blackstone to keep a portion of all investment profits generated for clients.

So when BX makes billions of dollars on an investment for a pension fund, the company gets to keep a portion of those profits. And if you invest in BX, you'll participate in those profits.

Blackstone pays a variable dividend based on profits over the previous quarter. So while your income payments may vary from quarter to quarter, the trend has been up for several years.

Based on the last four quarters of dividend payments, shares of BX currently pay you a dividend yield of 5.1%.

That's a lucrative amount of income! And you get to buy shares on sale from where they were trading at the beginning of the year.

Another dividend stock to consider is Apple Inc. (AAPL). Apple declared its first quarterly dividend of $0.095 per share (adjusted for stock splits) 10 years ago.

Since then, the company has continued to increase its dividend year after year.

With the company's deep pockets and reliable profits, I expect these dividend payments to continue growing for years and years.

And as AAPL grows profits and uses some of its cash to buy back shares of stock, you should see the price of your shares continue to rise over the long term. That helps to grow your wealth while you collect income.

Finally, consider an energy dividend play like Devon Energy (DVN).

Thanks to years of underinvestment in new oil and natural gas resources, the world has a major problem.

We simply don't have enough oil and gas to meet demand. And with Russian oil and gas now taken off the market, the world is facing a full-blown energy crisis.

That's bad news for our economy. But it's good news for energy companies that actually have access to oil and natural gas reserves.

DVN has a diversified portfolio of oil and gas wells spread across several different geological formations. The company's resources are estimated at 1.6 barrels of oil equivalent.

Investors in DVN receive reliable dividend payments tied to the company's oil and gas profits.

In December 2020, DVN paid a quarterly dividend of just $0.11. But thanks to higher oil and gas profits, DVN's quarterly payments hit a high of $1.27 per share this past June.

If DVN continues to pay quarterly dividends at this level, investors will receive more than a 7% dividend yield. That's a great way to beat inflation!

Of course, every investment involves risk. And in today's turbulent market, stock prices may ebb and flow.

But owning stocks of companies that generate reliable profits and pay lucrative dividends is a great way to protect your wealth and offset inflation.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King