Posted July 29, 2022

By Zach Scheidt

Whipsaw Inflation: Don't Let Your Guard Down!

If you think the volatility in the stock market has been bad, wait till you see what happens to inflation over the next few months!

This has been an incredibly important week for investors. And today we're going to take a look at some of the key information that will affect your retirement investments.

I should warn you... It's not a pretty picture.

But ignoring the warning signals could lead to a whipsaw injury that could take your retirement years to recover from!

So let's take a close look at what's happening...

The U.S. Economy... What a Mess!

On Wednesday, the Fed hiked its target interest rate by 75 basis points (or 0.75%).

As you may already know, this was the second rate hike of this size in just a few weeks. We haven't seen rates jump this far in such a short time in decades!

Jerome Powell and his colleagues at the Fed are raising rates to slow the economy, put the brakes on, and keep inflation from spiraling out of control.

Meanwhile, we're already seeing some big shifts in inflation.

Gasoline prices have moved lower…

Industrial commodities like steel and iron ore prices are pulling back…

And higher interest rates are putting pressure on home prices.

In fact, Jerome Powell appeared to be taking a bit of a victory lap during his press conference this week.

He told investors that the Fed will be "data dependent" when deciding what to do at the next Fed meeting.

This is a very different tone than the "we'll fight inflation at any cost" perspective the Fed has had previously.

Meanwhile, on Thursday we were told that the U.S. economy contracted for a second straight quarter.

Yes, that means for all intents and purposes, we're in a recession — though we have to wait for the recession to be certified before it becomes official.

With inflation pulling back and the economy in recession, investors now expect the Fed to be much more accommodative...

Which sets up a whipsaw scenario for inflation.

Inflation Whipsaw Is Coming

Now that the economy is effectively in a recession and inflation pressures are easing, there's a high probability that the Fed will pause its interest rate hikes.

Heck, traders are already betting on the Fed cutting interest rates within the next year.

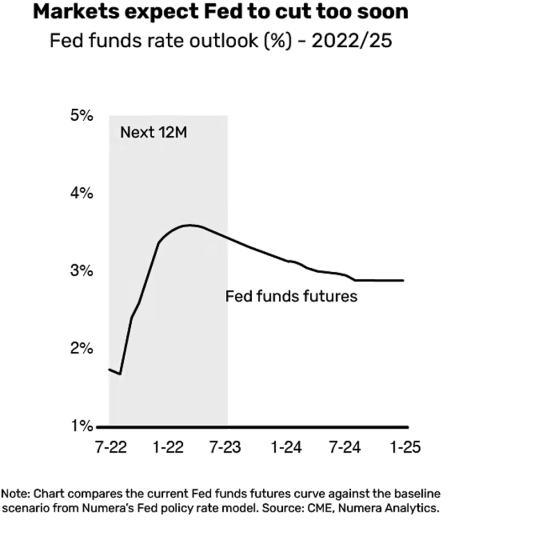

The chart below shows where traders expect the Fed's target interest rate to be in the future. As you can see, those bets show a decline in interest rates in early 2023.

But if Jerome Powell lets off the brakes, it could easily lead to another inflation surge late next year — perhaps even bigger than the one we've just experienced!

Of course, if inflation were to spike again, it would mean the Fed would need to raise interest rates even further. And in this scenario, the Fed would lose any credibility it still has left.

This is exactly the kind of whipsaw inflation we had during the 1970s.

It appeared inflation was backing off several times only to rear its head again. And it took drastic measures by the Fed to ultimately kill inflation at the expense of the overall economy.

If we're heading down this road, it's bad news for investors.

Not only will speculative stocks ultimately trade lower, but they'll also bounce along the way when inflation temporarily dies down.

These bounces can suck investors into bad stocks only to spit them out with losses a few months (or weeks) later.

Don't get caught in that trap.

I'll have a lot more to say about this whipsaw inflation danger. And we've got plenty of strategies to help you protect and even grow your wealth during this challenging period.

But please take today's warning to heart. We're not out of the woods yet and there are a lot of risks for you to manage.

I'm here for you and my team and I will be doing everything we can to guide you through this tough market environment.

Here's to living a Rich Retirement!

Zach Scheidt

Editor, Rich Retirement Letter

RichRetirementFeedback@StPaulResearch.com

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King