Posted September 17, 2021

By Dave Gonigam

Worried About a Market Crash?

[Note From Zach: If you’ve been paying attention to financial news outlets lately, I’m sure you’ve seen the headlines about a looming market crash. So, should you start taking these warnings seriously? Here’s an article weighing in on the topic from my colleague and editor of 5 Min. Forecast Dave Gonigam.]

It’s impossible to get away from the doomy headlines in the mainstream business press…

“Suddenly Everyone Thinks the Stock Market Is Going to Plunge” is how Yahoo Finance greeted its readers one morning recently.

Ditto the front page of that day’s Wall Street Journal: “After a record-breaking bull run for the

U.S. stock market this year, many Wall Street analysts are starting to warn that investors could be in for a bumpy ride in the coming weeks and months.”

CNBC reminds us “September has historically been a down month for the markets... And after eight months of straight gains, strategists say a major pullback could be imminent.”

Meanwhile, Deutsche Bank is among the many mainstream finance firms warning of an imminent “hard correction.”

Should You Take These Warnings Seriously?

On the one hand... it’s tempting to say if the mainstream is all leaning one way, you’re better off taking “the other side of the trade.” Double down on your bullish bets.

But on the other hand, it never hurts to ask: “What if they’re right?”

It’s been 10 months since the stock market experienced even a modest 5% pullback — much less a 10% “correction” or, God forbid, a 20% “bear market.”

No, that’s not to say the bull market that started 18 months ago is nearing an end. Just that we’re overdue for a nasty spill -- maybe something like the summer of 1998.

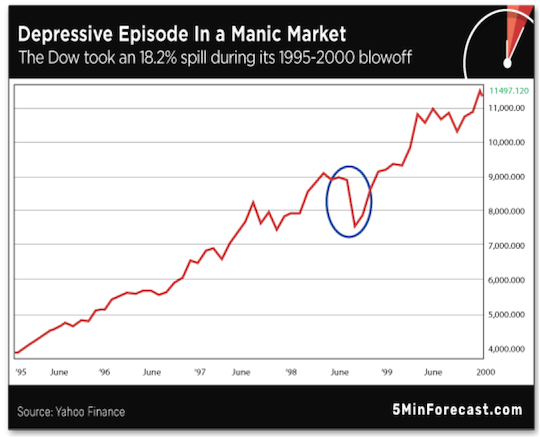

Let’s rewind: The stock market was in the midst of an epic five-year run that climaxed with the the peak of the dot-com bubble in early 2000.

But in that summer of ‘98, a wave of Asian currency collapses that began the previous year came to a head with a default by the Russian government... and the collapse of the hedge fund Long Term Capital Management.

In only seven weeks, the Dow tumbled 18.2%.

And then the market took off again, soaring to one new high after another.

Now, if you were in the markets in 1998, think back. And if you weren’t, just imagine.

How likely is it you would have had the conviction to hold on tight — and resist the impulse to sell?

No shame in your answer; giving into that impulse is only human.

But the price of giving in is even steeper than you might think. Ask yourself: How long would you likely have waited for the market to go back up before you got back in? In other words, how much of the recovery would you have missed? Again, be honest. We’re talking about all-too- human reactions here.

A “Disaster Insurance” Policy — Just In Case

Now consider this: What if you had devoted a tiny portion of your portfolio to a hedge that gave you peace of mind during that 1998 pullback — so you didn’t give in to the impulse to sell?

That could change everything, right?

Again, we’re overdue for a pullback here in 2021. It could happen anytime for any reason. For all we know, this coming Monday could be the next “Black Monday” — the stuff of future stock market legends.

But if you could devote, say, 1% of your portfolio to a “disaster insurance” trade... you could breathe easy. You wouldn’t panic about the losses elsewhere in your portfolio. Depending on how events played out, this one trade could make you 40 times your money in just weeks or months if the market crashes like we are expecting — and significantly pad your retirement account.

Best regards,

Dave Gonigam

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King