Posted September 01, 2023

By Zach Scheidt

September Is the Worst Month… Except When THIS Happens!

Welcome to September!

A brand-new month on the calendar… the unofficial end of summer… and a terrible season for the stock market. Or so they say.

September has a bad reputation among investors as the worst month for returns. And it's a fair reputation.

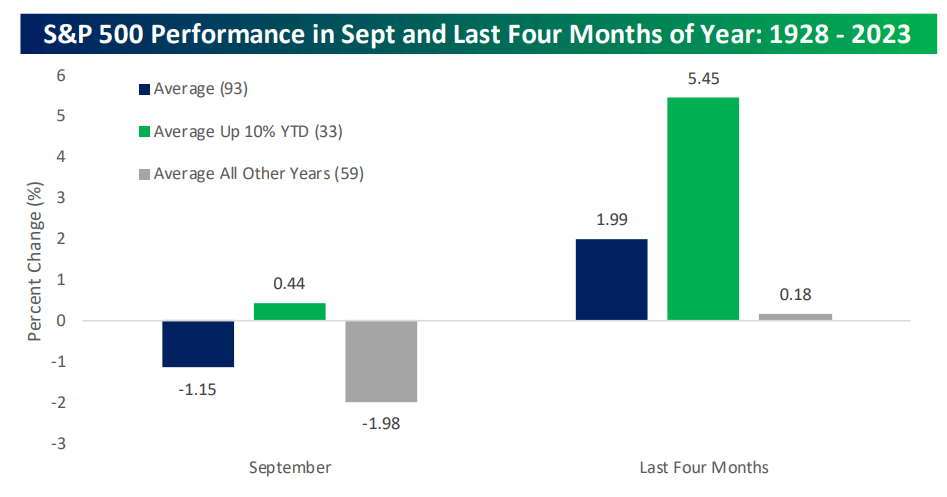

According to quant research firm Bespoke Investment Group, the average stock market return in September is negative 1.15%.

That's a pretty crappy track record for the month.

This statistic alone probably makes you want to sell all of your stocks, go into investment hibernation, and set an alarm to wake you up when September ends, as the song goes.

But there's an important wrinkle to this statistic — one that makes this September one you should consider keeping your investments in play.

More importantly, this wrinkle points to some much larger gains through the end of the year.

So if you sell your investments too soon, you could be missing out on a chance to grow your wealth substantially.

Let's take a look!

The Bullish September Caveat

While August was a tough month for investors, the truth is we're still in a bull market.

Stocks bottomed in October of last year and cleared the technical 20% rebound hurdle to enter a new bull market this summer.

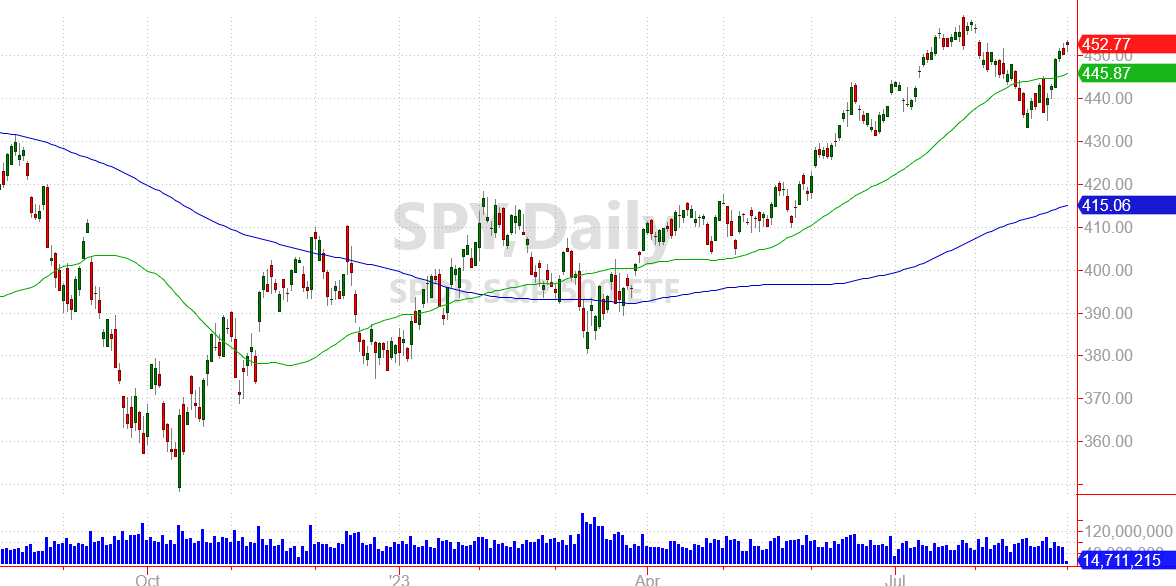

Take a look at the chart of the S&P 500 below.

As I write out this alert, the total return for the S&P 500 index is a bit more than 19% including dividends. Therein lies the wrinkle…

Again, according to Bespoke Investment Group, the average market return for September is positive 0.44% when the market is up more than 10% heading into the beginning of the month.

That's because bull trends tend to continue as investors gain more confidence. At least until some major event or risk turns investor sentiment negative.

The news gets even better when we look at a longer period.

In the last four months of the year, the average market return has been 1.99%. That's a pretty low number compared to the first eight months of an average year.

But if you only look at the years when the S&P 500 is up more than 10% heading into the last four years of the month, that gain nearly triples to 5.45%.

Here's a quick graph of those statistics for those of you who appreciate visuals like me.

Bottom line, this September looks like a much more positive period than many expect.

And there are plenty of other bullish factors like the presidential cycle, the average length of a new bull market, and the potential for the Fed to pause (and eventually cut) rates.

So don't bail out of your investments just yet!

Discretion Is Key

Of course, you know that I'm no Pollyanna when it comes to this market environment.

I'm still concerned about many of the high-priced speculative tech stocks. And earlier this week, we talked about the major challenges retail companies are facing.

So it's important to use discretion when picking which stocks to invest in, and which areas to avoid.

I'm currently very bullish on energy stocks as the price of oil moves higher...

I'm excited about the newfound strength we're seeing for gold...

And I still think travel stocks could have a ways to run.

Here at Rich Retirement Letter, my team and I will continue to work hard to find you the best opportunities to grow and protect your wealth.

Rest assured, if we see storm clouds on the horizon, we'll let you know. And I'll have plenty of suggestions for protecting your wealth even when markets are trading lower.

But for now, it's still time to play offense. Stay invested in high-quality dividend-paying stocks that will benefit as our economy continues to grow.

I hope you have a wonderful holiday weekend.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King