Posted September 11, 2023

By Zach Scheidt

Spoiler Alert: Inflation Is NOT Under Control

I hate to be the bearer of bad news...

But you need to know that we are not out of the woods when it comes to inflation. Not by a long shot!

This week, the Bureau of Labor Statistics will release its report on the Consumer Price Index, an important measure of inflation for families like yours and mine.

And while inflation may not be as white-hot as it was this time last year, I'm preparing for a reading that’s hotter than the Federal Reserve is comfortable with.

It all ties back to a chart I've pasted below…

The Problem With Higher Oil Prices

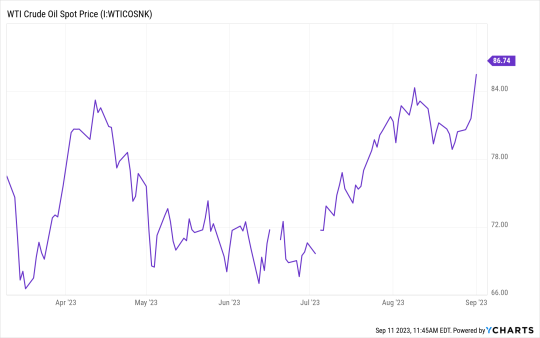

Take a look at the chart below that shows U.S. crude oil prices over the last six months.

As you can see, crude oil has been marching higher over the last several weeks. And this is true even while the overall stock market has been pulling back.

There are several reasons for this surge. And the reasons in play right now could continue to drive oil prices higher.

First, the U.S. has very low inventories of available crude oil.

This is a concern because when you have low supplies of an important commodity like oil, buyers have to compete with each other to buy limited amounts of oil.

And in a free market, the only way to compete is to offer higher prices.

It certainly doesn't help that President Biden drained much of our Strategic Petroleum Reserve last year, while simultaneously chastising U.S. oil companies.

We won't go too far down the political rabbit hole, except to say that the current administration is not helping to make this problem better.

Second, foreign organizations like OPEC+ have decided to cut production to intentionally drive oil prices higher.

This serves a dual purpose of hurting the U.S. economy while lining their pockets as they sell oil for higher prices per barrel.

Thankfully, the U.S. has become more self-reliant when it comes to energy production over the past few years.

But as OPEC+ cuts production to the rest of the world, global energy prices are still reacting to the lack of supply.

Finally, certain parts of the U.S. economy remain resilient.

This includes the travel industry (which burns a tremendous amount of jet fuel and gasoline), and manufacturing (which relies on oil and natural gas for much-needed energy).

As the U.S. economy keeps chugging along, demand for oil remains very high. Economics 101 tells us that high demand coupled with low supplies naturally drives prices higher.

So it should be no surprise that oil prices are rising, even as we reach the end of peak driving season in the U.S.

Now, how does all of this tie back to inflation and the Fed? Let's connect the dots!

How Energy Prices are Driving Overall Inflation

Here at Rich Retirement Letter, we've talked a lot about the way that inflation is reported.

Many people (including Fed members) prefer to strip out volatile price movements in the food and energy areas to come up with a core inflation number.

This has always been a point of frustration because food and energy have a big impact on practically every household budget.

You might think that the core inflation number will overlook the important rise for crude oil. And that's true to some extent.

But even inflation from energy still eventually bleeds through into the core inflation numbers. Here's why...

When you buy a shirt at your local store or Amazon, the price of that shirt is still affected by oil.

That's because the raw materials need to be delivered to the factory. The factory uses energy to keep its equipment running.

Then the finished goods need to be delivered to the store or your home. And this entire process is still energy intensive.

So the ultimate price you pay for a shirt — or any number of other goods and services — is ultimately affected by the price of oil.

I look at the price of oil like a canary in the coal mine. It tells us that inflation is picking back up and that the Fed will need to continue being restrictive to achieve its goal of 2% inflation.

So we're not out of the woods yet. And as investors, we need to be ready for a long, hard battle against inflation and all that comes with it.

Bolstering Your Retirement Against Inflation

Fortunately for us, there are plenty of great ways to grow your wealth even during periods of above-average inflation.

First, it makes sense to own energy stocks. After all, higher oil and gasoline prices will boost profits for these important companies.

As an added benefit, most oil stocks are currently trading at very low prices compared to the profits that these companies generate.

So you're getting some great values when you buy energy stocks.

Second, consider both industrial and precious metals. Sure, gold hasn’t yet definitively pushed above $2,000 per ounce.

But I expect gold to move higher amid inflation, especially if the Fed is pressured to leave interest rates unchanged because of the huge amount of debt our government carries.

Industrial metals like copper, steel, aluminum and others are still in high demand as our economy grows.

That’s especially true since the Biden administration has made it a priority to bring manufacturing jobs back to the U.S.

Imagine how much steel we’ll need to build all the new factories, not to mention the metals that go into all of the products we expect to produce.

Finally, it's still a good idea to own long-term bonds. As I mentioned last week, long-term Treasury bonds offer you a lot of value.

That's because you can now receive plenty of income from these investments.

And there’s plenty of room for these bonds to trade higher, especially if the U.S. enters a recession.

So bonds can be a great safety net on top of generating plenty of income for your retirement.

To wrap it all up, I'm concerned about inflation and this week's inflation report. But I'm confident that you can still protect your retirement wealth, even in this challenging environment.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King