Posted February 13, 2023

By Zach Scheidt

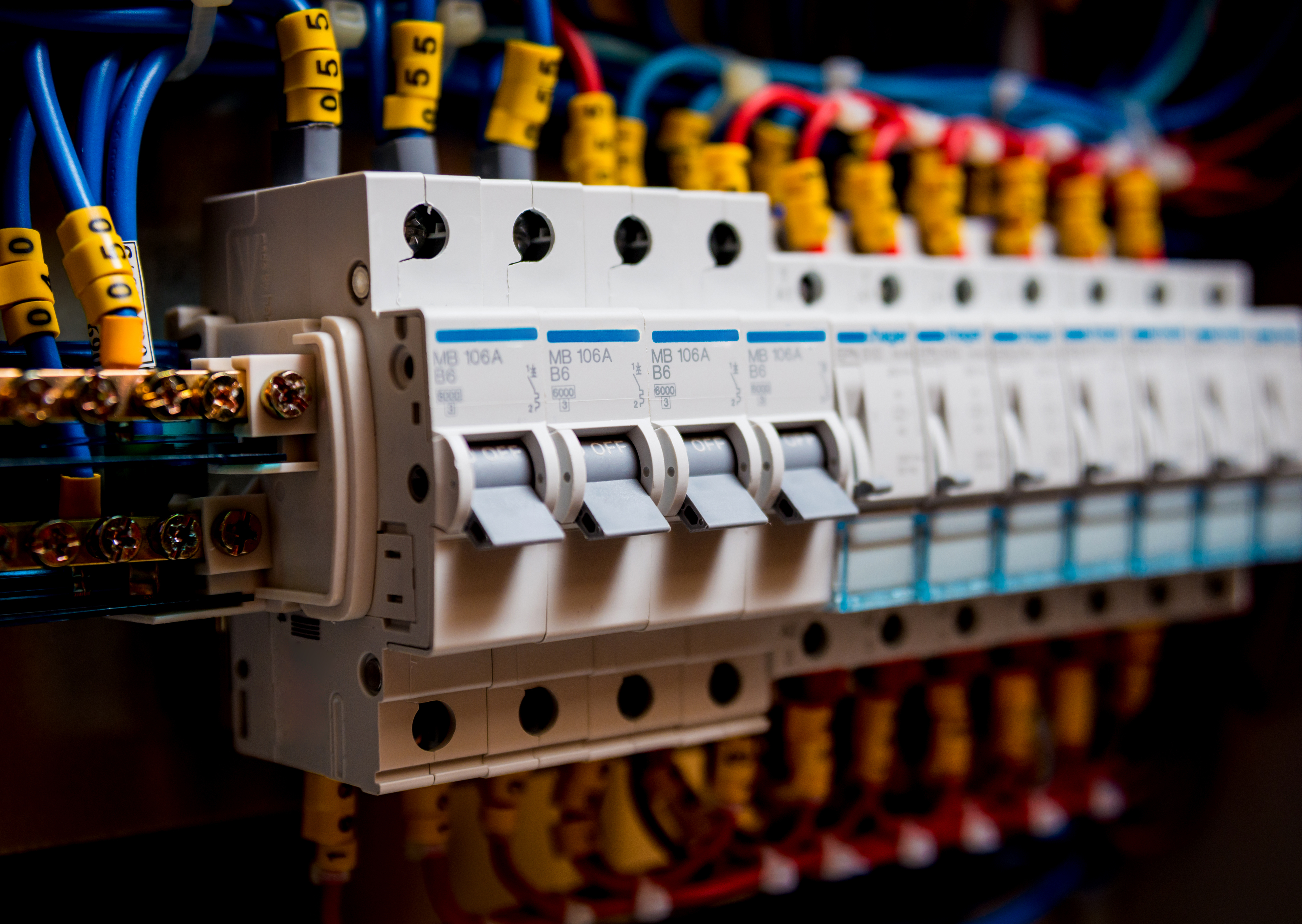

This Important Circuit Breaker Is Almost Gone

Last summer I moved my 21-year-old daughter into an apartment.

She had to go to work after getting everything moved in, so I told her I would come back later to help her hook up a used washer and dryer we bought her.

Later that evening I got a panicked phone call…

"Dad, I plugged in the cord and there was a loud BANG! Now all the lights in the building are out."

It turns out she plugged in the 220-volt cord before attaching the other end to the dryer. The cord completed the circuit and shorted out her entire apartment building.

I'm thankful the building's circuit breaker kicked in. Otherwise, someone could have been hurt and she could have started a dangerous fire.

Did you know the stock market has some important circuit breakers too?

Today, I want to explain how one of these natural safety measures works. Unfortunately, there's a rising risk that this safety buffer actually won't work next time we need it.

Let's take a look.

The Short Seller Safety Valve

Short sellers, or investors who make bearish bets on stocks, fill an important role in the stock market.

Unlike traditional investors, these traders make money when stocks trade lower and lose money when stocks trade higher. Here's how it works...

Short sellers borrow shares from a broker and then sell them in the open market. Eventually, they have to buy the shares back and give them to the lending broker.

If the stock price drops, a short seller can buy at a cheaper price. Their profit is the difference between the price they originally sold and the lower price for buying back the shares.

But if the stock rises, a short seller will lose money. The higher the stock trades, the more a short seller will have to pay to buy back shares to return to the broker.

Here's why short sellers are so important.

Short sellers are required to give the borrowed shares back to their broker, so they need to buy the shares back at some point.

That means when the market trades lower and traditional investors are afraid to buy, short sellers are among the first buyers to step in and support stock prices.

And the more shares are held short, the more natural buying power there is to help stop a falling market. See what I mean about a natural circuit breaker for the market?

Now that you understand how this process works, let's take a look at how short sellers are faring right now…

Short Exposure Nears Record Lows

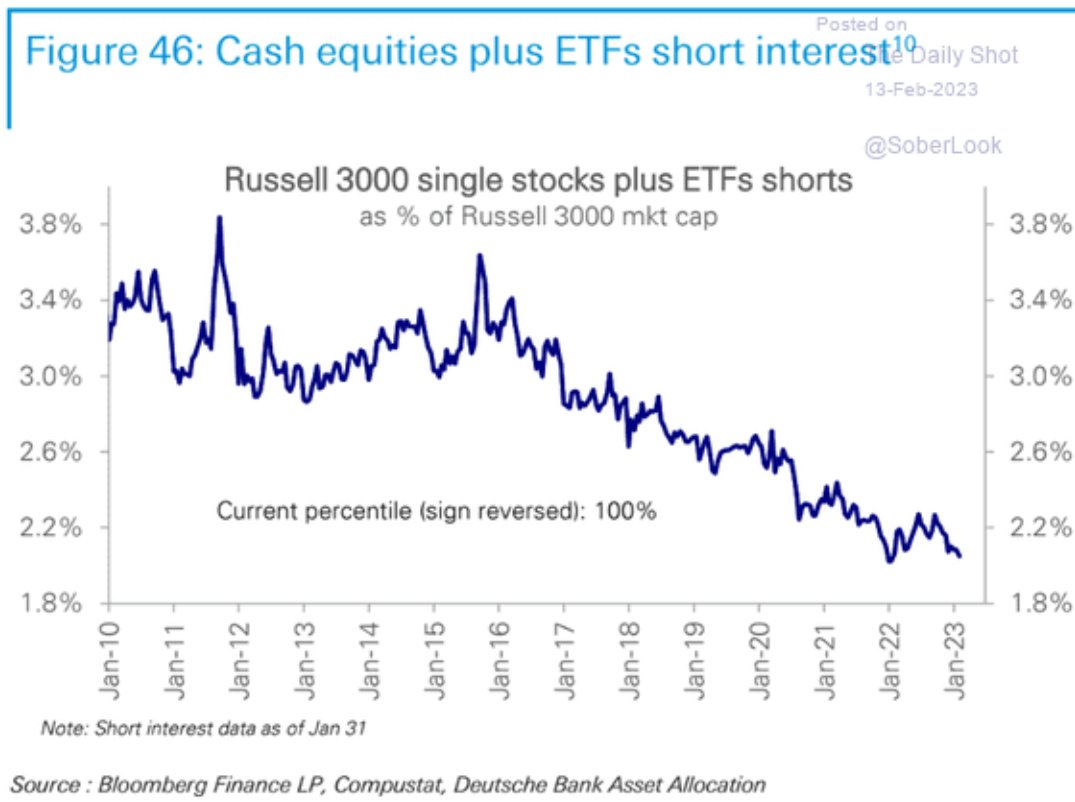

This morning I posted an important chart on my Twitter feed. (You can follow me on Twitter for real-time insights throughout the trading day.)

This chart shows the level of short selling in the market. As you can see, short selling is near a multi-year low.

I'm concerned that with fewer short sellers in the market, there's less of a buffer in case stocks trade lower.

In other words, this circuit breaker that usually helps keep stocks from falling isn’t set up. That means the market (and especially speculative stocks) have more risk than usual.

So it's critical to focus on protecting your wealth, which also means you should avoid the riskiest stocks that have a long way to fall.

The stock market has been exceptionally strong this year, with risky companies dealing in artificial intelligence, cloud computing, and streaming media often leading the pack.

Make sure to review my list of five dangerous stocks from last week. If you own any of them, consider selling before the stocks trade lower.

In today's market, it's more important than ever to invest in quality companies that generate real profits... pay attractive dividends... and trade at reasonable prices.

If you focus on these stocks, you'll be able to protect your wealth even if the market circuit breakers fail and stocks slide lower.

And remember that protecting your wealth is every bit as important as finding the next big winning stock.

How Others’ Incompetence Costs You Big-Time

Posted January 17, 2024

By Byron King

Turning Empty Cubicles Into Houses

Posted January 15, 2024

By Zach Scheidt

"Boring AI": Overlooked Opportunity From CES 2024

Posted January 12, 2024

By Zach Scheidt

5 Must-See Predictions

Posted January 10, 2024

By James Altucher

Welcome to Earth, the Mining Planet

Posted January 08, 2024

By Byron King